The role of women in business management worldwide is steadily increasing. By 2023, the percentage of female executives is expected to surpass 10% in the world’s largest Fortune Global 500 companies for the first time. Kursiv Research is examining the status of female business leadership in Uzbekistan, starting with small businesses and progressing to banks, the corporate sector and large enterprises.

Women matter

Women’s leadership can have significant economic benefits. The 2015 McKinsey Global Institute report revealed that promoting gender diversity in government and the private sector could add $12 trillion to global GDP over a decade. Companies in the top quartile are 21% more likely to be top earners.

According to Credit Suisse, from 2006 to 2011, companies with a market capitalisation of over $10 billion and at least one woman on the board of directors saw their share value increase 26% faster than corporations with exclusively male-dominated boards.

The Peterson Institute for International Economics study of 22,000 public companies in 91 countries founds that increasing the proportion of women in management from 0 to 30% resulted in an average 15% increase in net profit margin.

As evidenced by the pandemic, women managers are more effective in times of crisis than men at all levels of management. Researchers from the National Research University Higher School of Economics explain this fact by noting that women CEOs tend to have higher levels of education and greater risk appetite, enabling them to develop innovative strategies that enhance company efficiency during challenging times.

Additionally, a BCG study demonstrates a connection between gender diversity in leadership and a firm’s innovation potential.

Female-leaders in small businesses: Progress and challenges

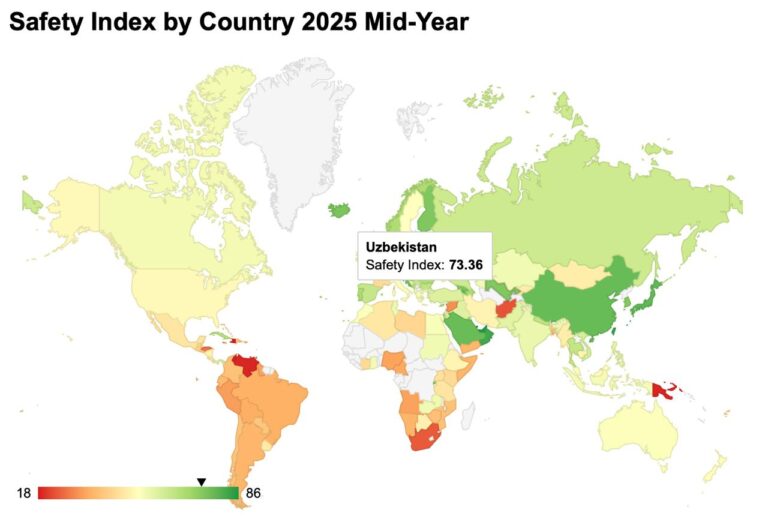

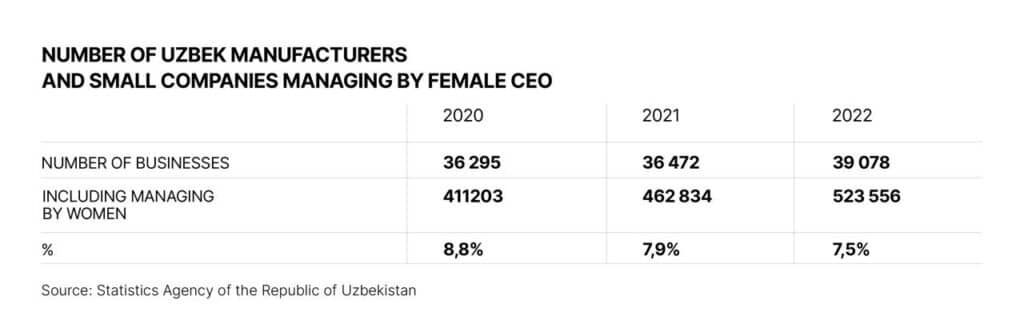

As of the end of 2022, Uzbekistan had 39,078 small and micro-firms led by women, which accounted for 7.5% of active small businesses. This percentage has decreased slightly from 8.8% over the past three years, showing slower growth than the total number of firms.

The majority of women-run firms are located in Tashkent (10,906) and Tashkent Region (4,995), followed by Samarkand Region (3,289), Karakalpakstan (2,593) and Khorezm Region (2,363).

Regarding financial indicators, annual net revenue for women-owned firms is 620 million soums, whereas 928 million soums for male-owned firms, representing a 49% gap based on 2021 data.

Additionally, annual investment in fixed capital per enterprise for women is half that of men, amounting to 97.2 million soums compared to 198.3 million soums in 2022.

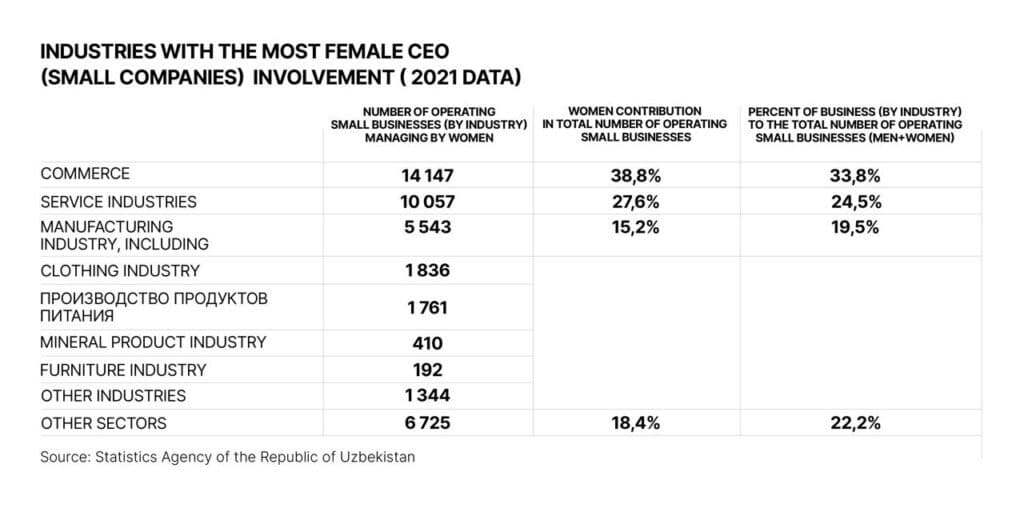

The sectoral structure of women’s small businesses also reflects a gender imbalance, with women being overrepresented in trade and services sectors and underrepresented in the industry.

In the industry sector, most women-led firms are in traditional areas of female work dominance, such as cloth, textiles, and food manufacturing.

Possession does not mean domination

Looking at business ownership, the percentage of active small and medium enterprises owned by women has almost doubled from 14.9% to 29.2% since 2019, indicating that women now own approximately 150,000 businesses out of a total of 527,222 active firms.

However, men still lead at least 70% of women-owned firms when considering medium-sized businesses.

Moreover, analysis of female-owned businesses in the Interfax-SPARK information system shows that male directors manage a significant portion of firms with one or more female owners.

Additionally, in businesses where men and women are equally represented among the beneficiaries, male directors account for more than half of the management roles, and in companies where men own the majority, their share among managers is close to 100%.

In conclusion, the data suggests that female leadership in SMEs is closely tied to ownership, indicating that the larger a woman’s share of a business, the more likely she is to lead it.

However, there is an asymmetric relationship, as men manage a significant share of firms owned by women, while it is rare for a woman to manage predominantly or entirely male-owned businesses.

Countryside is ruling

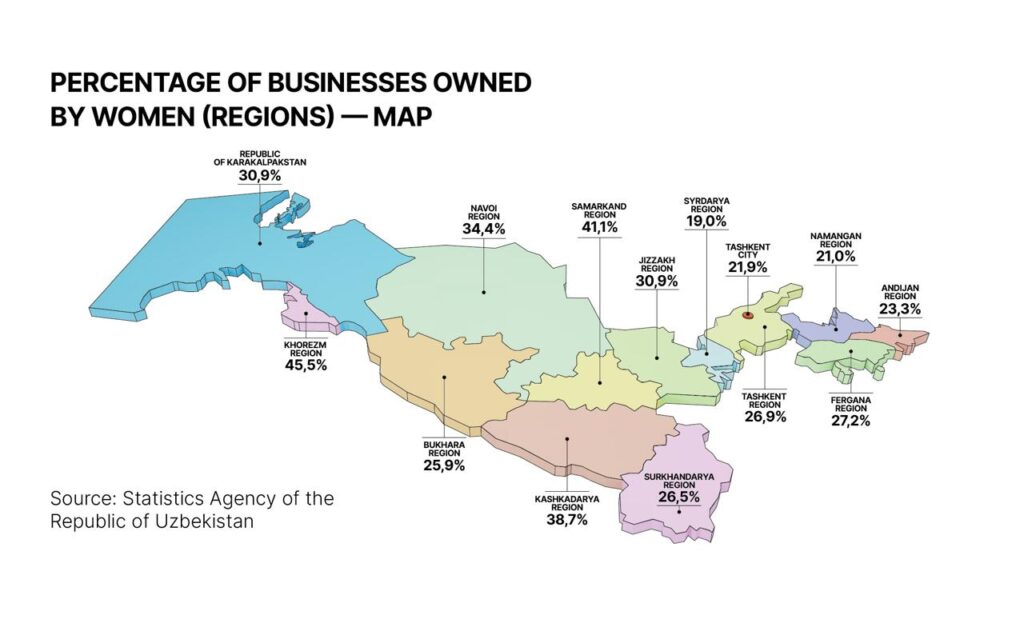

The top three regions in terms of the percentage of firms with female owners are Khorezm (45.4%), Samarkand (41.3%), and Kashkadarya (38.7%). On the other hand, Syr Darya (19%), Namangan (21%), and Tashkent (21.9%) are at the bottom of the list.

The underrepresentation of women in the capital and the adjacent Tashkent region is noticeable. Despite concentrating about 30% of SMEs and generating the highest surplus value, this macro-region needs more female-owned businesses.

The regions with a higher share of women-owned enterprises than the national average are predominantly rural. For instance, Khorezm Province has only 33% of the urban population, and Samarkand Province has 37%. In contrast, the most urbanised Namangan region (65%) is among the outsiders.

The disparity between urban and rural areas exacerbates the gender imbalance, resulting in unequal access to borrowed resources. Uzbek banks are hesitant to issue small loans, which are crucial for rural businesswomen. Transportation costs and the time needed to reach the bank are also further barriers.

In rural areas, women often decide to “own” a business because they have no other employment opportunities due to a lack of education, family control, and widespread unemployment. This necessity-driven entrepreneurship has little chance of growing beyond self-employment.

One to seven

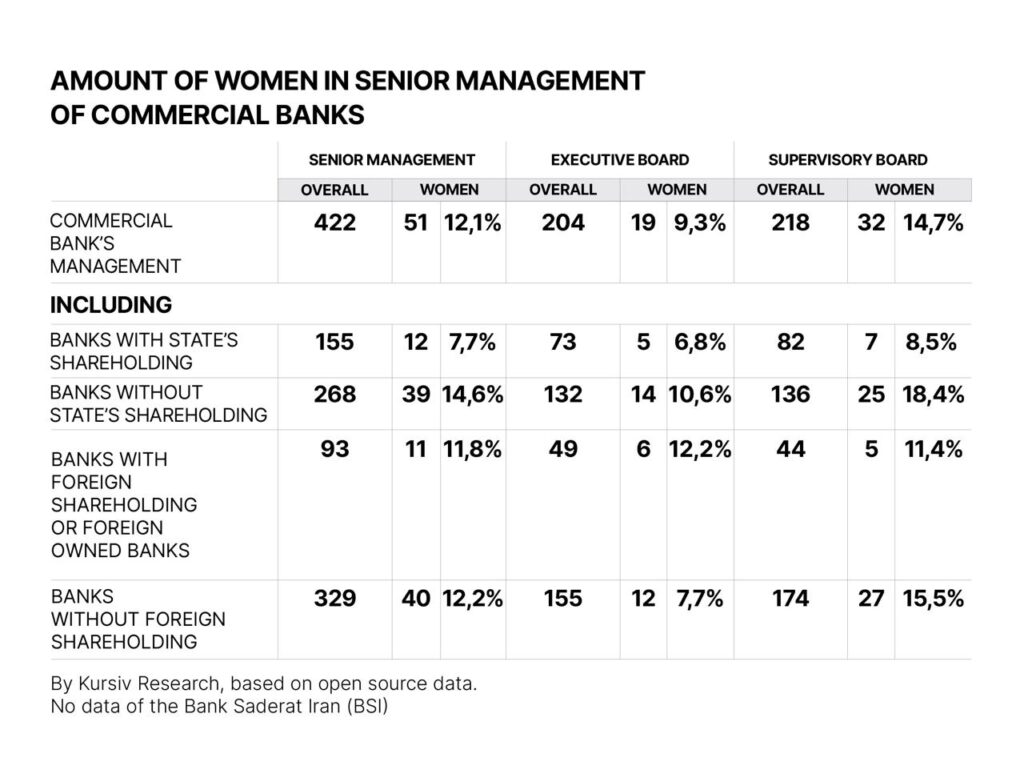

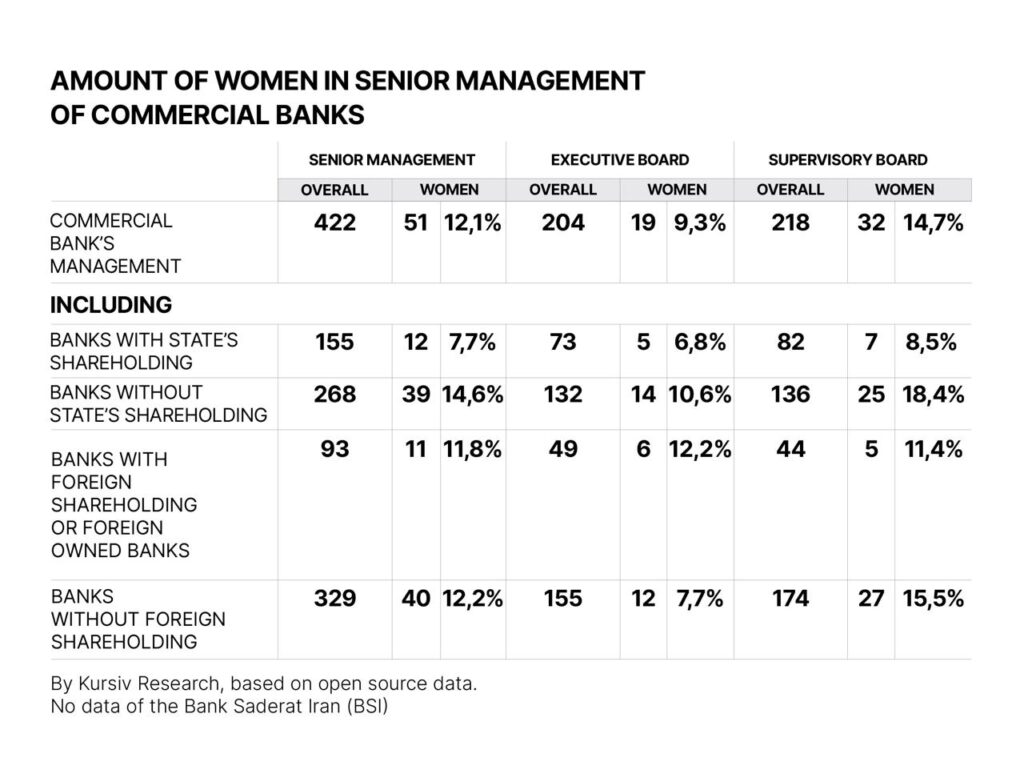

When it comes to women’s representation in managing Uzbek banks, there are, on average, seven men for every woman. This figure is 2.1 percentage points above the ten-percentile bar the Fortune Global 500 set.

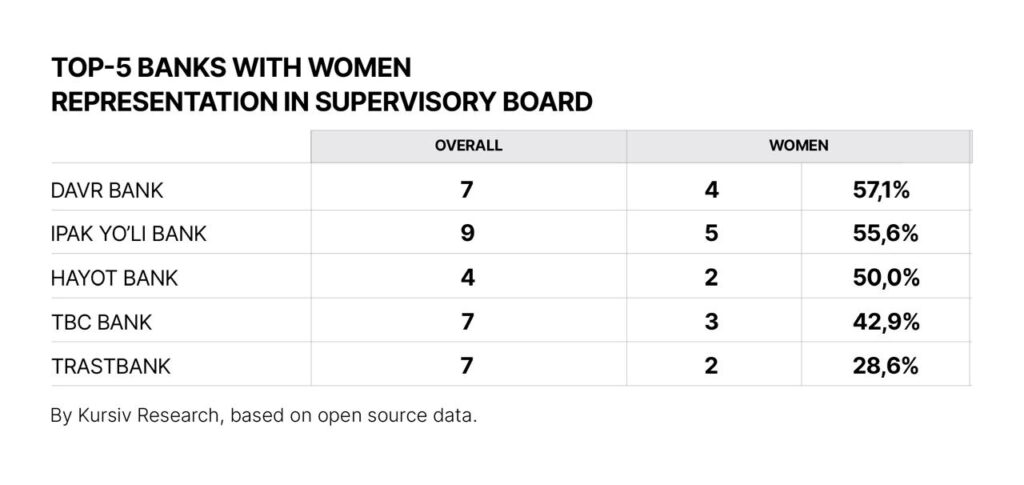

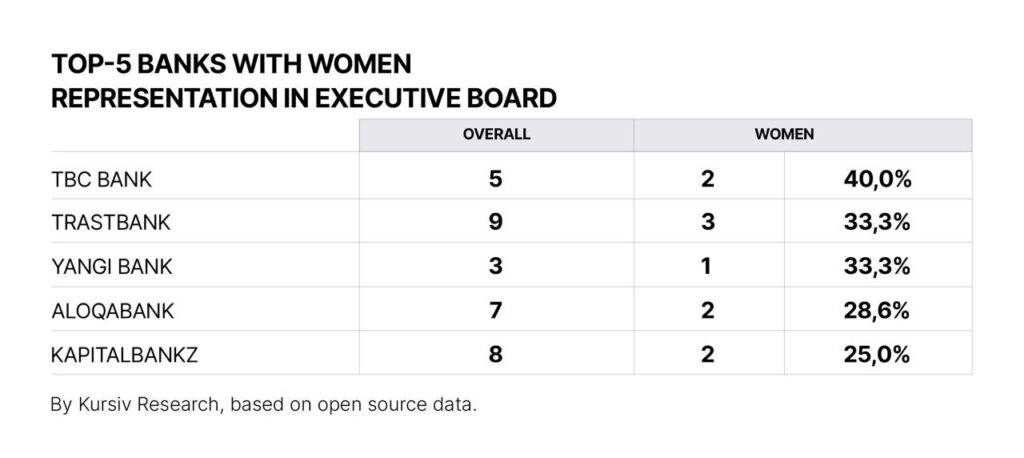

As with many other countries, executive boards in Uzbekistan tend to be more “patriarchal” than supervisory boards elected by shareholders. The ratio on the management board is 1 to 10, while on the supervisory boards, it is 1 to 6.

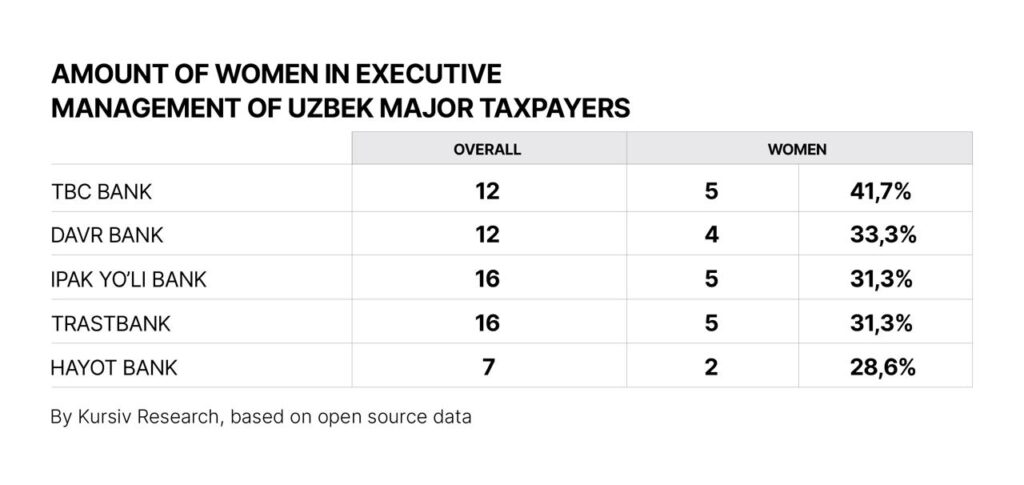

Among banks, TBC ranks first regarding gender diversity on the management board (2 out of 5) and overall (5 out of 12).

The second-ranking bank is Trastbank, where women hold one-third of the executive body seats and 42% of all managerial positions.

“Davr Bank” leads in women’s representation in the supervisory board (4 out of 7) and ranks second overall.

Furthermore, Ipak Yuli Bank and Hayot Bank have also achieved 50% gender parity in the supervisory board.

Out of the top ten leaders of domestic banking, only Kapitalbank was mentioned in at least one of the ratings. With a score of 2 out of 8, it ranks fifth regarding the share of women on the board.

Market rules

Our research indicates that the likelihood of encountering a female CEO is twice as high in a 100% private bank compared to a state-owned institution – 15.6% vs. 7.7%.

However, two institutions had a female CEO in both sectors. Kammuna Irisbekova is the pre-manager of Aloqabank (100% state-owned), while Svetlana Khe heads the board of Yangi Bank.

Moreover, banks on both sides have no female top managers. These are “private” KDB, AVO, Madad Invest, Universal Bank, Uzum, and “state-owned” BRB, MKBank, and Halyk Bank.

Small banks not reliant on state bureaucracy are more likely to promote women, although there are exceptions among such organisations.

Most banks with a state stake strive formally to include one or two women in their management.

Delicate East

Foreign investments may be seen as promoting gender diversity in the Uzbek banking sector. However, our research shows that the share of women managing banks partially or wholly owned by foreigners is slightly below the average (11.8%). They have more women on their management boards than locally owned banks but fewer on their supervisory boards.

Most foreign players in the Uzbek banking market seem to come from countries where Western corporate culture has not deeply taken root, such as the former USSR and socialist camps (Kazakhstan, Georgia, Hungary), Turkey, and South Korea.

Notably, TBC, a “post-Soviet” bank, is the most progressive. “Western” banks like Hamkorbank (22%—Dutch Development Bank) and InFinBank (35%—Swiss Capital International Group AG) are on par with the Turkish Ziraat Bank.

Commanding heights

To assess gender diversity in the corporate sector’s top management, we analysed the composition of the executive bodies and boards of directors of 18 of the 20 largest taxpayers in 2022*.

The share of women in the total number of top managers is 6.6%, 6% among the members of the Management Board, and 7.4% in the Boards of Directors.

In 12 out of 18 companies, the management consists only of men. No corporation has a woman as CEO or Chairman of the Management Board.

UzBAT is the leader in the overall rating: 5 women out of 13 top managers, one on the management board, and four on the board of directors. The cigarette manufacturer is the only taxpayer from the top quartile with female participation in management. However, this is a very controversial leadership because all women on its board are citizens of Kazakhstan.

Uzmetkombinat is in second place, with four women out of 18 “tops,” three on the management board and one on the board of directors.

Fergana Oil Refinery is third, with two out of 18 in general management, both on the management board.

Consequently, today’s large industry is the most problematic sector regarding women’s representation in top management. Vertical gender segregation is more pronounced here than in banking and small business.

*Information on Coca-Cola Ichimligi Uzbekiston and Tobacco Uzbekistan is not available.