The primary task of the Central Bank is to ensure price stability. Therefore, the regulator sets a target inflation rate of 5% in Uzbekistan, using monetary policy instruments, with the base rate as the main monetary measure. Kursiv discovered how the recent fall of the base rate from 14 to 13.5% affects the country’s economy.

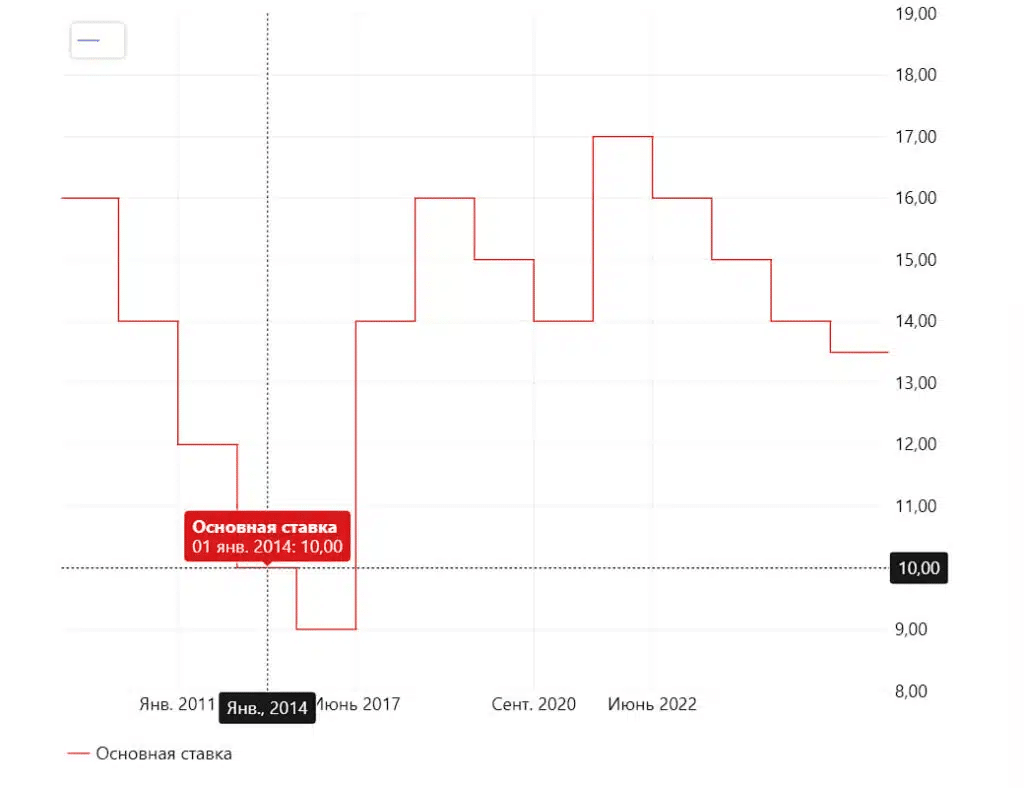

The changes of the Central Bank base rate over the past ten years

The base rate was high in the early years of Uzbekistan’s independence. It started at 150% on May 2, 1994, increased to 225% in October of the same year, and peaked at 300% in March 1995.

The rate gradually decreased to 10% until January 2014 and dropped to 9% in January 2015 (the lowest in history).

In June 2017, the rate rose to 14%; in September 2018, it increased to 16%, remaining at this level until April 2020. Due to the pandemic’s impact, the regulator first cut the rate to 15% and then to 14% in September 2020.

The conflict between Russia and Ukraine also affected Uzbek economy, leading the Central Bank to raise the rate to 17% in March 2022. The rate gradually decreased to 16% in June 2022, 15% in July, and 14% in March 2023.

The Central Bank’s Board decided on July 25, 2024, to lower the base rate to 13.5%.

How does a rate cut affect the country’s economy and banking sector

Reducing the base rate primarily impacts the interest rate at which banks can borrow money from each other. This is reflected in the cost of deposits and loans for individuals and legal entities.

Eldor Zakirov, the head of the Monetary Policy Department of the Central Bank, mentioned,

«The rate cut will affect the reduction of deposits and loans interest rates. However, we cannot predict the exact rate. In addition, the country’s base rate did not actively change previously. According to the IMF analysis in 2022, a 1% change of the base rate affects the change of lending and deposit rates by 0.5%. Therefore, deposit and loan rates in Uzbekistan should decrease by at least 0.25%. It’s a gradual process.»

He also noted that the deposits and loans interest rates are influenced by the Central Bank’s base rate and the cost of resources, such as foreign loans that banks take and refinance.

“Global resource costs remained low until 2022, allowing Uzbekistan’s banks to access foreign resources at favourable interest rates and issue loans at lower rates. However, rising inflation led country regulators to raise rates, making foreign resources more expensive. Consequently, commercial banks focused on attracting internal resources, resulting in increased competition for deposits in the country,” he specified.

On July 25, during the press conference, Mamarizo Nurmuratov, chairman of the Central Bank of the Republic of Uzbekistan, announced that the rate cut would primarily impact adjustable loans tied to the base rate.

Nurmuratov noted, “This will directly impact educational, preferential mortgage loans, and family businesses loans tied to the base rate.”

Nurmuratov added that the rate cut would affect repo operations, overnight, and deposits.

“Directly linking loan interest rates to the base rate could be inaccurate, as the relationship between borrowers and banks should be based on the borrower’s solvency margin.”

How do developed countries determine the base rate

In developed countries, the base rate is determined using the Taylor rule, recognised by international economists. According to this rule, the base rate must be at least one percent above the inflation rate, explained Eldor Zakirov

According to the Central Bank of Uzbekistan forecast, by the end of the year, inflation in the country should reach 9%, and by December 2025, it will approach 5%.