According to a recent study by Kursiv Research Uzbekistan, over 70% of Uzbek residents living in the country’s top ten cities know something about biologically active supplements (BAAs), and approximately one-third of individuals use them occasionally.

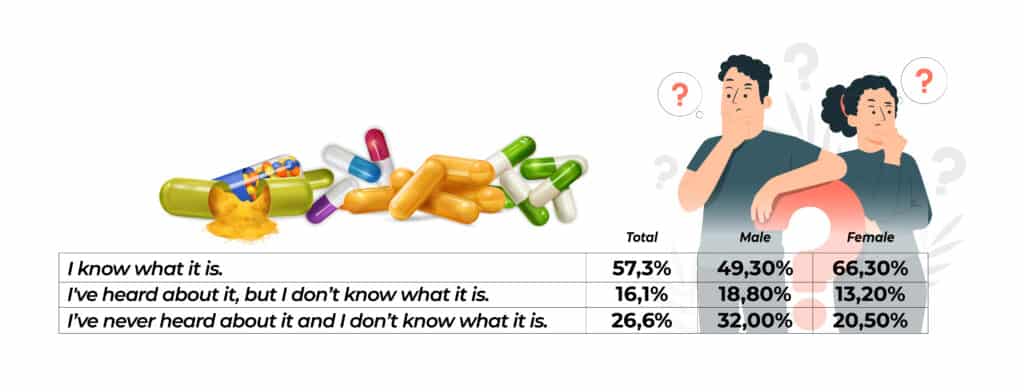

The study found that urban residents are pretty aware of dietary supplements, with 73.4% having heard of them and 57.3% feeling confident in their understanding. Around 26.6% of respondents reported having never heard of bioactive supplements.

Do you know what supplements are?

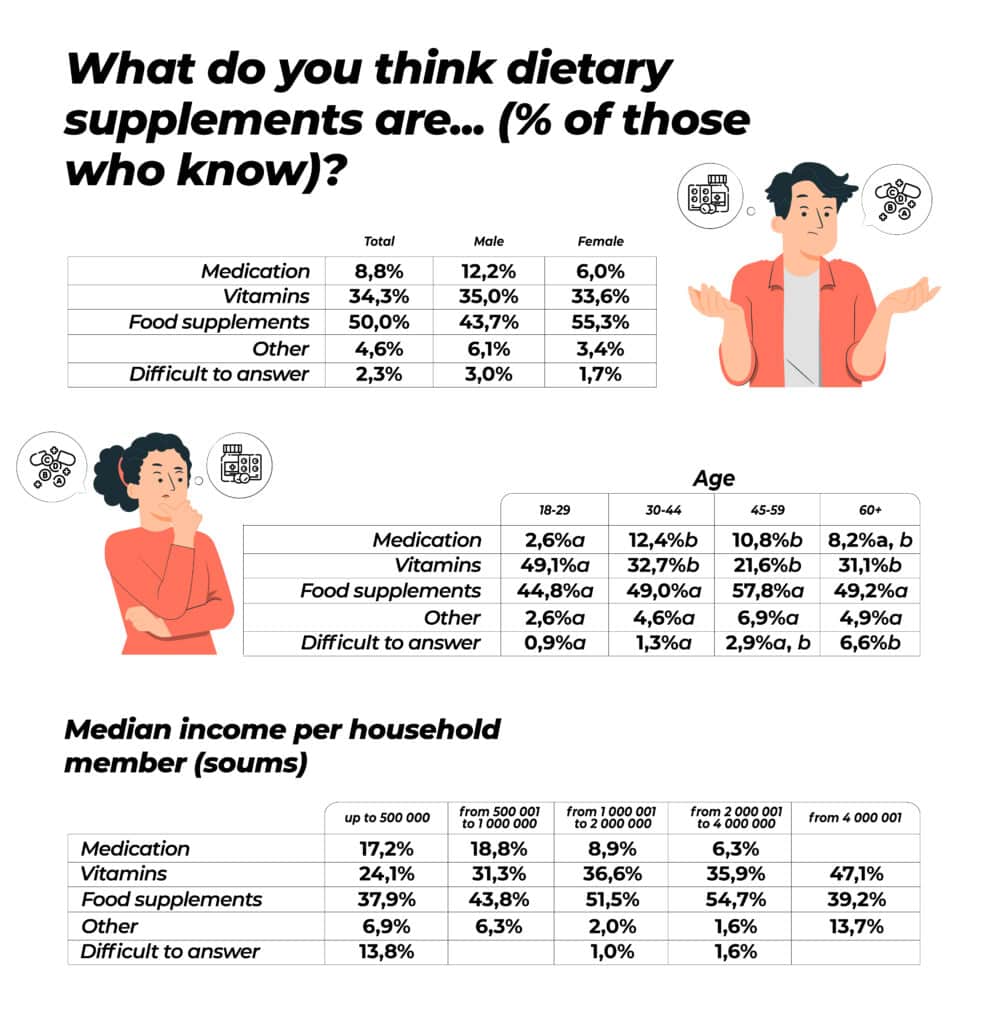

Half of the individuals confident in their knowledge of supplements believe that they are food additives, 34.3% associated them with vitamins, and 8.8% viewed them as medicines.

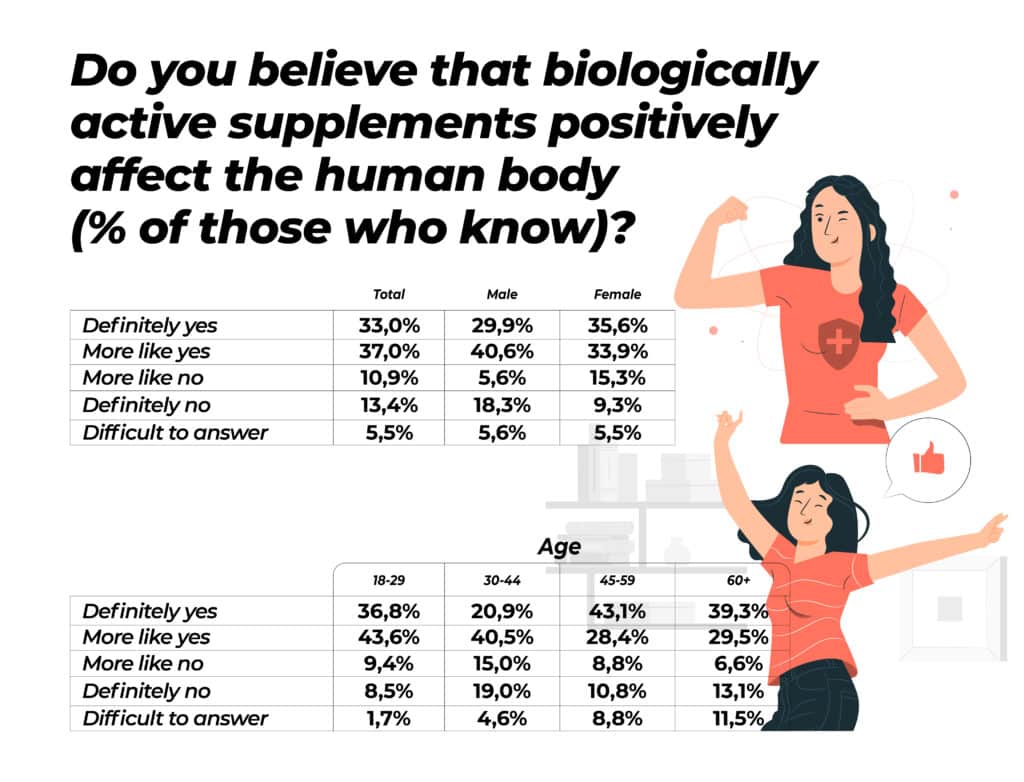

The study also reveals that 70% of those knowledgeable about supplements believe that it positively impacts the human body.

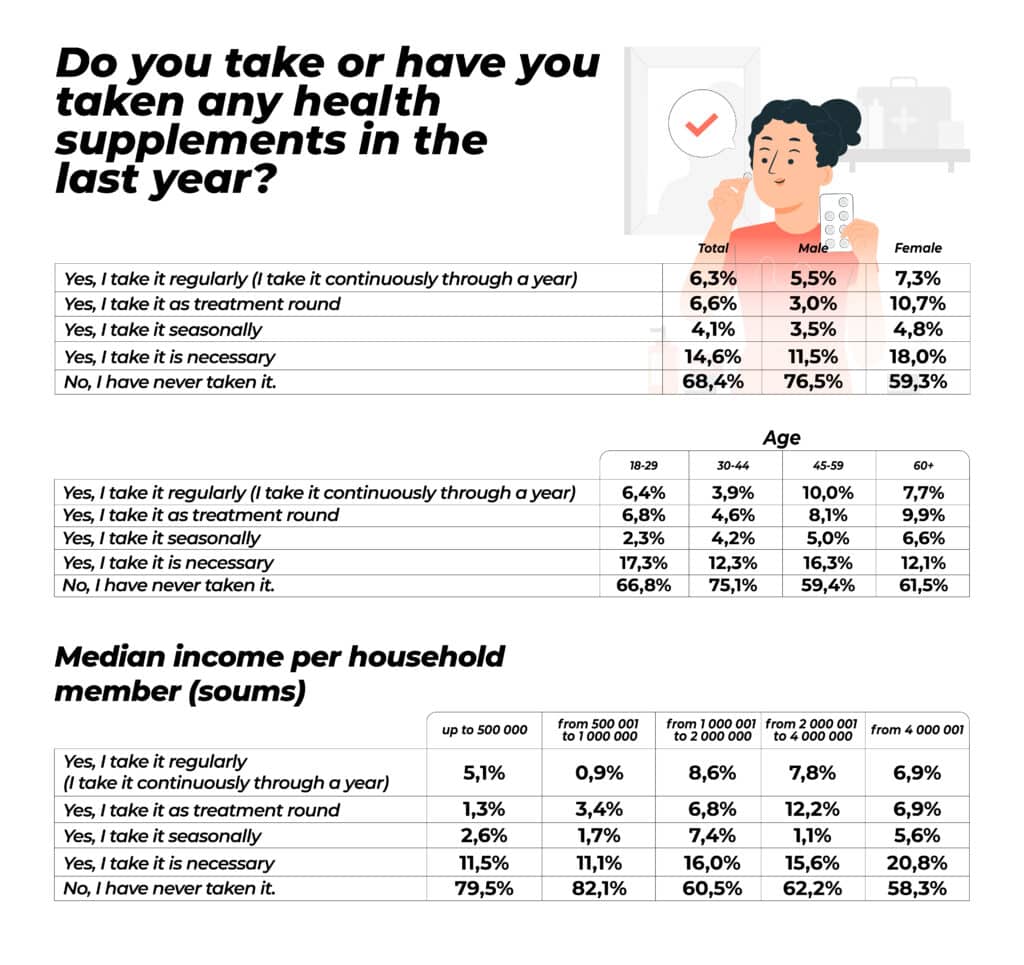

In terms of usage, approximately 31.6% of city dwellers reported taking bioactive supplements frequently, with 14.6% doing so as needed. Only 6.3% of respondents claimed to consume dietary supplements constantly throughout the year, 6.6% take them in courses, and 4% chose to use them seasonally.

Ladies First

There are differences between genders when it comes to awareness of dietary supplements. Women demonstrate higher awareness, 66.3% knowledgeable about nutritional supplements, compared to 49.3% of men. Additionally, 55% of women know nutritional supplements as food additives. On the other hand, men are more likely to choose the “Medicines” option (12.2% vs. 6%).

The overall confidence level regarding the benefits of dietary supplements is similar for both genders. 70.5% of men and 69.5% of women either definitely or rather believe that taking nutritional supplements is good for the body.

However, more men are firmly against nutritional supplements, with 18.3% choosing the “definitely not” response, compared to 9.3% of women. Furthermore, 40.7% of women take supplements regularly, which is almost twice as many as men (23.5%). This is because women tend to take supplements in courses (10.7% vs. 2%) and use them as necessary.

“Supplementary” Tashkent

Tashkent shows a higher level of awareness among the other cities included in the survey. 85.7% of Tashkent residents have at least heard of dietary supplements, and 75.5% are confident that they know what they are. The lowest level of awareness is in Margilan. About every second person has heard something about supplements, and 29.4% of respondents know what they are. The capital leads in additive consumption. 42.5% of Tashkent residents take supplements regularly, with the lowest index in Andijan at 14.3%.

Generation X over Generation Z

It’s interesting to note that Boomers are more knowledgeable about dietary supplements compared to Millennials and Zoomers. The closer people are to retirement, the more likely they are to be informed about the topic, with 63.7% of 45 to 59-year-olds and 67% of those in their sixties and older being knowledgeable.

Among 45-59-year-olds, dietary supplements are most commonly defined as food additives. On the other hand, about half of young adults (18-29 year-olds) believe that nutritional supplements and vitamins are the same.

Trust in dietary supplements is varied. The most sceptical group is well-informed 30-44-year-olds, with 19% not believing in supplements’ benefits.

On the other hand, 89.7% of well-informed respondents aged 18 to 29 believe supplements are beneficial.

Interestingly, the most convinced supporters of dietary supplements are the 45-59-year-olds, with 43% believing in their benefits. This age group is also the most likely to use supplements, with almost 40% of respondents in this category taking supplements and 10% doing so regularly.

The second highest usage is among people of retirement age, with 36.3% consuming bioactive supplements at least sometimes.

It can be assumed that in Uzbekistan, the interest in bioactive supplements is not so much due to marketing targeting a healthy lifestyle for the young as to the need to slow down negative processes associated with aging. This sets the country apart from the West and even from Russia, where urban youth are the primary buyers of dietary supplements.

Which is it: vitamins for the wealthy or medicine for the poor

Some believe that dietary supplements are a luxury that is affordable only to affluent urban residents. The higher the family’s income, the more likely they are to be knowledgeable about supplements and purchase them. Is this true?

The data supports this idea. Respondents from the high-income group (with over 4 million soums per family member monthly) are the most knowledgeable about supplements. 84.7% are familiar with or have heard of supplements, and over 70% are confident in their knowledge.

Conversely, the lowest level of supplement awareness is in the group with an average per capita income of up to 500 thousand soums. Only 54% have heard of supplements, and 37.2% are sure they know what it is.

The frequency of supplement intake is also higher among the richest group—40.3% vs. 20.5% of the poor group.

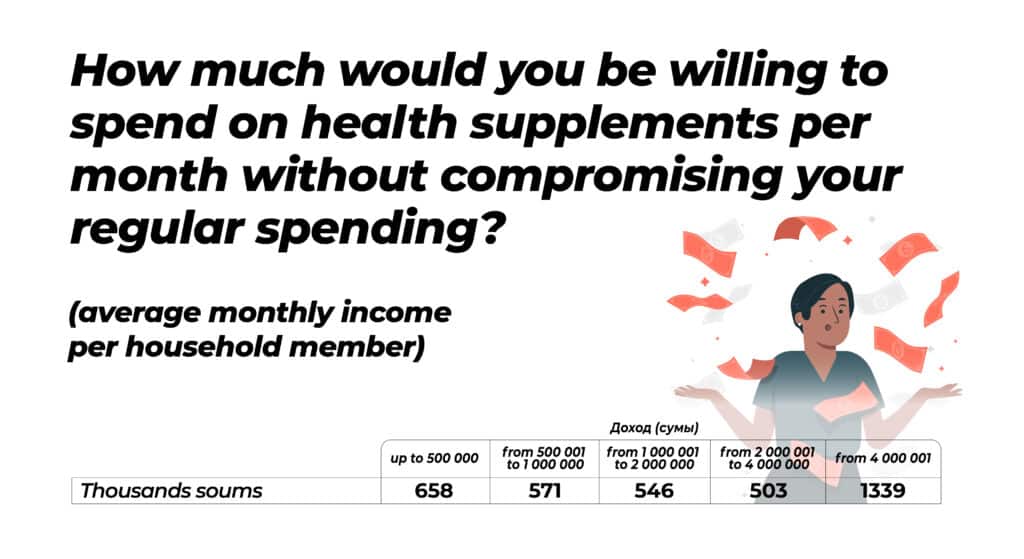

Regarding spending on supplements, the average monthly expenditure stands at 667 thousand soums. This estimate suggests that for all adult residents of major cities, the average expenditure may range from 550 thousand to 784 thousand soums.

Interestingly, the lowest income group spends more on supplements than those with an income eight times higher. Their average spending is 658 thousand soums, compared to 546 thousand soums for the group with an income of 2 to 4 million soums. However, a significant increase in average spending begins with an income of over 4 million soums, with the wealthiest spending more than double the average – 1 million 339 thousand soums.

Surprisingly, the poorest are willing to spend as much on dietary supplements as middle-income Uzbekistanis.

In the West, bioactive supplements are often referred to as “medicine for the poor,” indicating that disadvantaged individuals use them as a substitute for expensive medical treatments and remedies.

Low-income individuals cannot afford a diet that provides all necessary vitamins and micronutrients, so they seek “magic” supplements.

Our data supports this idea, showing that in groups with an average per capita income of fewer than one million soums, around 18% view dietary supplements as medicine – twice the average of 9.2%. However, this percentage is zero for the group with an income of over 4 million soums.

Additionally, about half of the richest (47.1%) believe that bioactive supplements are vitamins, while among the poorest, this opinion is held by almost half as many – 24.1%.

COVID consequences

The COVID-19 pandemic has led to a surge in the global demand for dietary supplements. According to Nielsen, sales in the primary U.S. market for the industry increased by 51.2% after the pandemic began as people sought to strengthen their bodies and improve their health. The healthcare system needed help to cope with the significant increase in the number of patients during this time.

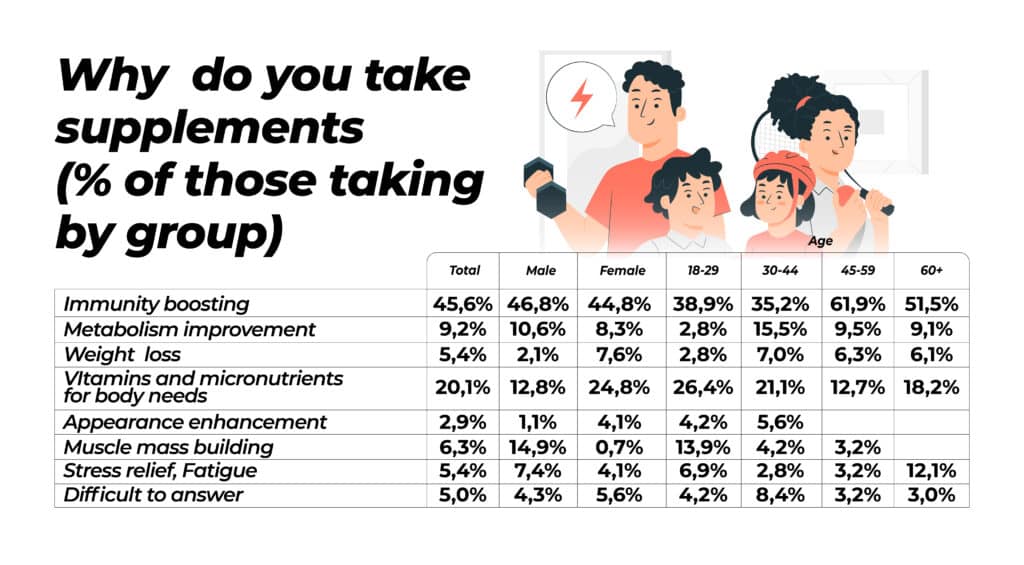

Our study reflects this trend, with 45.6% of individuals using dietary supplements to boost their immunity and 20.1% using them to fulfill their body’s vitamin and mineral requirements.

Age and gender differences were observed, with pre-retirement individuals being the most concerned with immunity (61.9%). In comparison, young people (26.4%) and women (24.8%) were more focused on addressing vitamin and mineral deficiencies. Elderly individuals were more likely to use dietary supplements to combat fatigue and stress (12.1%) and improve metabolism (9.1%), while men were more inclined to use supplements to build muscle mass (14.9%). In summary, while those with lower incomes relied more on the healing benefits of supplements, those with higher incomes tended to view them as a way to enhance their vitamin intake.

Offline vs Online

The COVID-19 pandemic has led to a notable increase in online sales of dietary supplements in Uzbekistan. One-third of respondents reported purchasing supplements from online stores and marketplaces, which is higher than the global average of 25%.

Additionally, 28% of respondents preferred buying from pharmacies, where, per a presidential decree from the previous year, at least 10% of the space must be dedicated to displaying lifestyle supplements.

Around 20% of people obtain dietary supplements from distributors and individuals, typical in a country like Uzbekistan, where a significant portion of the economy operates in the informal sector. Specialised stores accounted for 15.5% of supplement purchases.

There are distinct age-related preferences in purchasing habits. Younger individuals are more comfortable with online purchases, while older individuals opt for offline shopping. For instance, 28.6% of 45-59-year-olds bought supplements from distributors and individuals, while 27.3% of older people preferred purchasing from specialized stores.

The chosen purchasing channel also impacts the average amount spent on supplements. Those purchasing from pharmacies tend to spend less than those buying from online stores, distributors/individuals, or specialised stores. The average spend in pharmacies was 368 thousand soums, 724 thousand soums for online stores, 835 thousand soums for distributors/individuals and 837 thousand soums for specialised stores. The overall market for e-commerce in dietary supplements in Uzbekistan has yet to be saturated, indicating potential for further growth.

This information was gathered through a telephone survey (CATI) from August 21 to August 28, 2023, involving 756 respondents from various cities in Uzbekistan (Tashkent, Namangan, Samarkand, Andijan, Nukus, Bukhara, Karshi, Kokand, Fergana and Margilan). The sample was representative of the population in terms of gender and age.