Uzbekistan plans to open trading for foreign company shares on the local stock exchange and allow Uzbek firms to issue bonds in foreign currencies. The National Agency for Perspective Projects (NAPP) is currently drafting the presidential decree needed to implement these initiatives. On October 15, market participants gathered at the Chamber of Commerce and Industry to discuss the opportunities and risks involved, according to Kursiv Uzbekistan.

How the listing mechanism will work

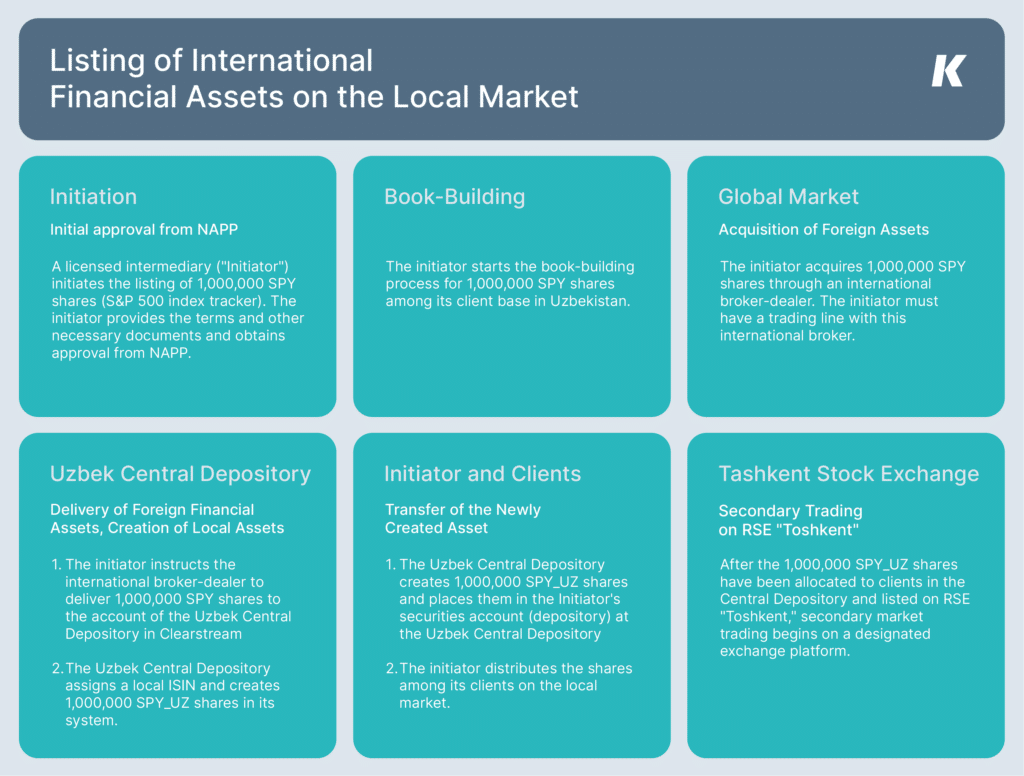

George Paresishvili, Chief Executive Officer at the Republican Stock Exchange (RSE) “Toshkent,” explained that an unsponsored listing, or admission to trading, requires a comprehensive approach.

«The regulator needs to approve each foreign share before it can trade on the local exchange,» Paresishvili said.

This approval process ensures close monitoring of the listed securities and safeguards investor interests. The procedure for unsponsored listing includes multiple steps, such as collecting client orders (book-building) and purchasing shares. Initially, the broker initiator submits a request to the Uzbek regulator for the shares’ market admission. After receiving the regulator’s approval, the broker acquires shares like Apple’s and deposits them with Uzbekistan’s Central Securities Depository which operates accounts with Euroclear or Clearstream.

Paresishvili noted that the Central Securities Depository will assign a local code to the securities once this process is complete. From that point, these shares will function the same as other securities on the RSE, following the same system and regulatory standards.

Example of an unsponsored listing

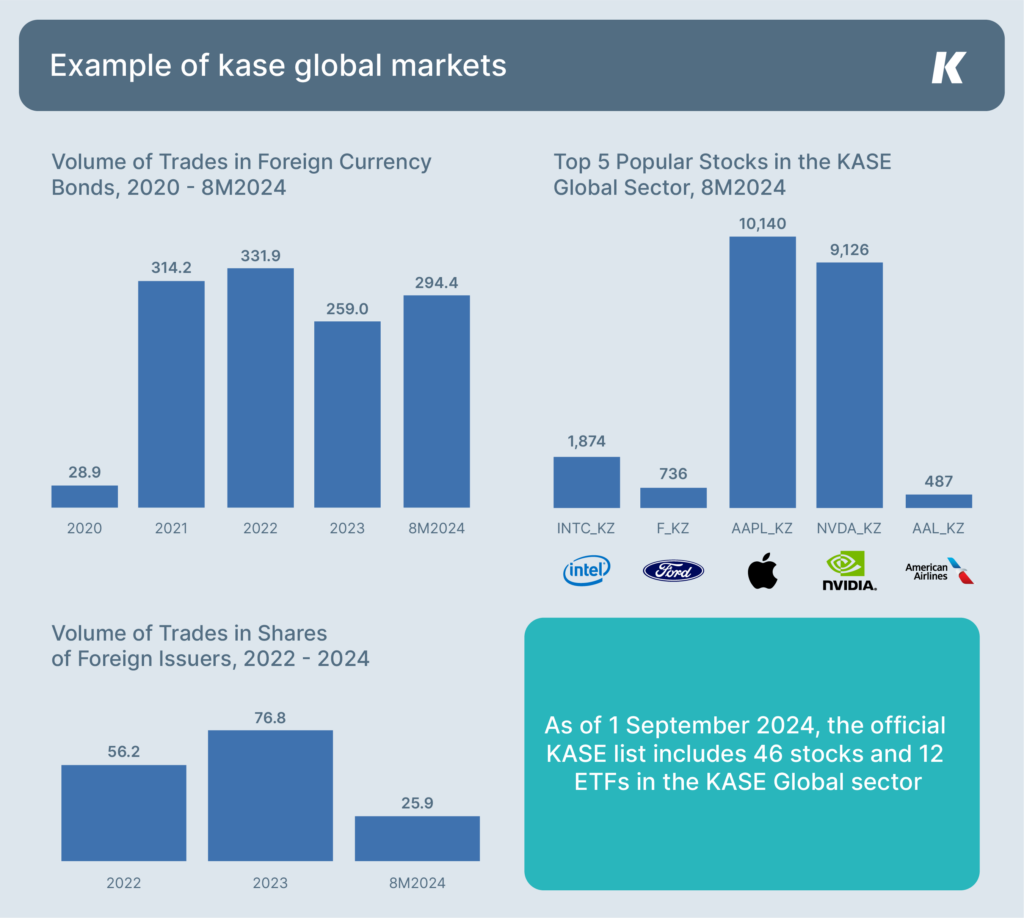

In a joint presentation by the RSE “Toshkent” and TBC Capital, Sergey Varin, Deputy General Director of Freedom Broker in Uzbekistan, discussed Kazakhstan’s success in establishing a platform for trading foreign shares on KASE. He highlighted that the involvement of market makers enabled foreign securities to trade locally in the morning, before US markets opened, providing investors with extra opportunities to manage risks. Kazakh brokers and international financial institutions collaborated closely to maintain market liquidity, ensuring stable settlements and proper asset accounting at the central depository.

Varin pointed out that Kazakh investors benefit from several tax advantages when trading through KASE Global, such as no capital gains tax on shares registered on the domestic exchange. This approach has made trading particularly attractive. He also stressed the value of partnerships with international depositories like Euroclear for integrating local and global financial operations.

Issuing bonds in foreign currency

Another significant initiative involves allowing local companies to issue bonds in foreign currencies. This measure aims to attract foreign investors who often prefer dollar-denominated bonds, as they may find currency risks in the local market too high.

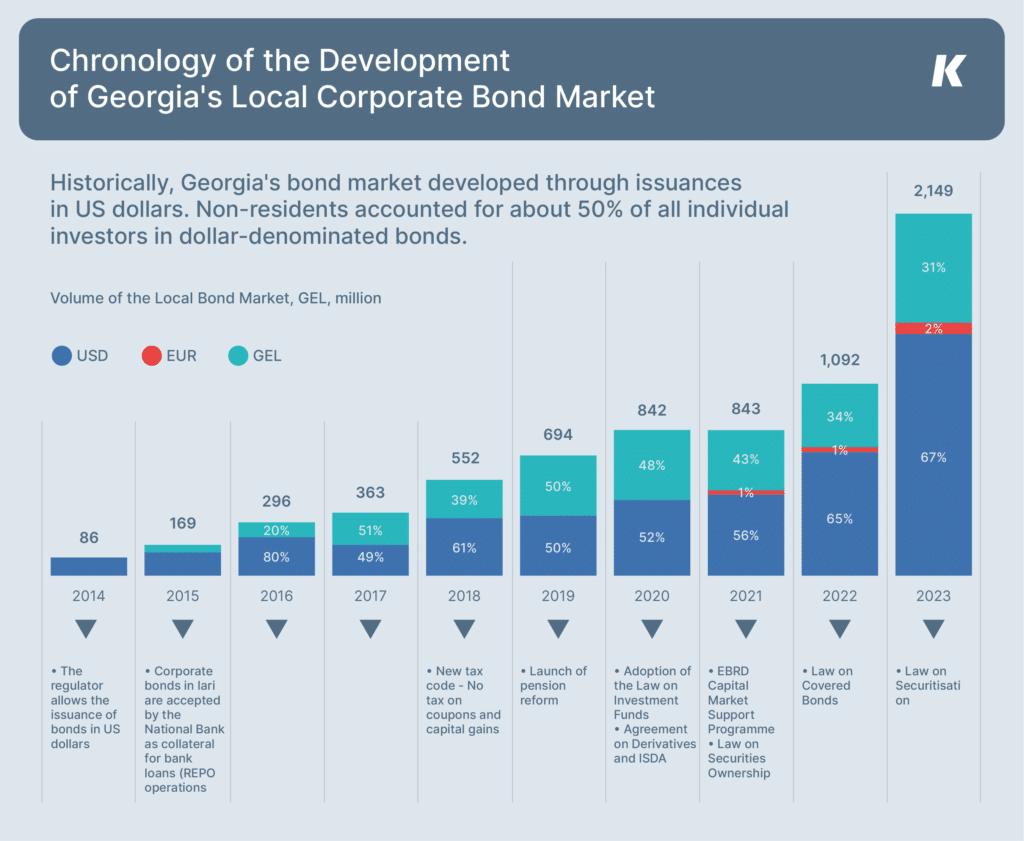

Otari Sharikadze, Advisor to the Deputy Chairman and Head of Asset Management at TBC, shared Georgia’s experience: «We are one of the largest investment banks in Georgia, and our investors see Uzbekistan as a suitable opportunity. However, the risks associated with the soum can be difficult for them to assess.»

He noted that Georgia’s regulatory changes began 10 years ago when authorities allowed companies to issue corporate bonds in dollars. Before this, all securities were denominated in lari, and the market had very limited activity. Since the shift, the market has grown rapidly, reaching $900 million, a significant figure for Georgia, Sharikadze added.

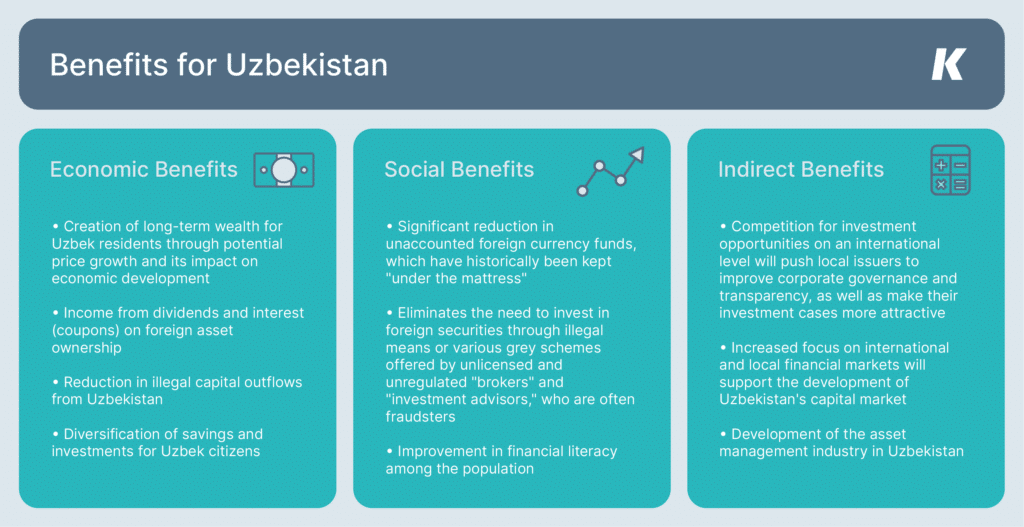

Sharikadze outlined the economic benefits Uzbekistan could achieve by implementing unsponsored listings and foreign currency bonds.

Impact on the economy

Karen Srapionov, Partner at Avesta Investment Group, addressed the need for economic transparency. He explained that introducing conditions for the unsponsored listing of foreign companies would improve control over capital movements and asset flows within Uzbekistan. This is an essential step in combating illegal financial activities and the unauthorised transfer of funds abroad. He emphasised the importance of maintaining full control over domestic assets to ensure that the judiciary can enforce debt recovery, including through the sale of foreign shares held by debtors.

Srapionov also discussed the value of foreign currency bonds for public and private companies, noting that issuing these instruments would significantly expand funding opportunities, attracting both local and international investors.

Victor Lebedev, Deputy Chief Financial Officer of Uzum Group, elaborated on the topic, stating that foreign currency bonds offer a way to raise capital and an opportunity to mobilise funds currently inactive in the economy. He estimated that the population holds about $10 billion in private funds, which could return to the economy through the issuance of bonds in foreign currency. Lebedev added that local investors would be more inclined to invest in Uzbek companies if they provided clear and transparent financial instruments.

He further highlighted that foreign currency bonds would give businesses flexibility in financing options, facilitate large-scale projects, and enhance the country’s investment appeal. According to his projections, issuing these bonds could attract around $90 million in investments during the first year, with steady growth expected in subsequent years.

Saibzhan Khudaiberdiev, Head of the Capital Market Regulation Department at the National Agency for Perspective Projects (NAPP), informed Kursiv Uzbekistan about the progress on a new presidential decree that would allow issuing securities in foreign currencies for both residents and non-residents. He stated that the document is in its final development stages and will soon undergo public discussion and interdepartmental review. The decree will not only permit the issuance of foreign currency bonds but also enable unsponsored listings of foreign shares on the local exchange, marking a significant step toward integrating Uzbekistan into global financial markets.

Khudaiberdiev stressed the need to update outdated securities market regulations, which do not reflect current business realities. A key aspect of the new decree will involve protecting citizens’ rights from fraudulent schemes in foreign markets and setting clear criteria for admitting foreign issuers to the local market.