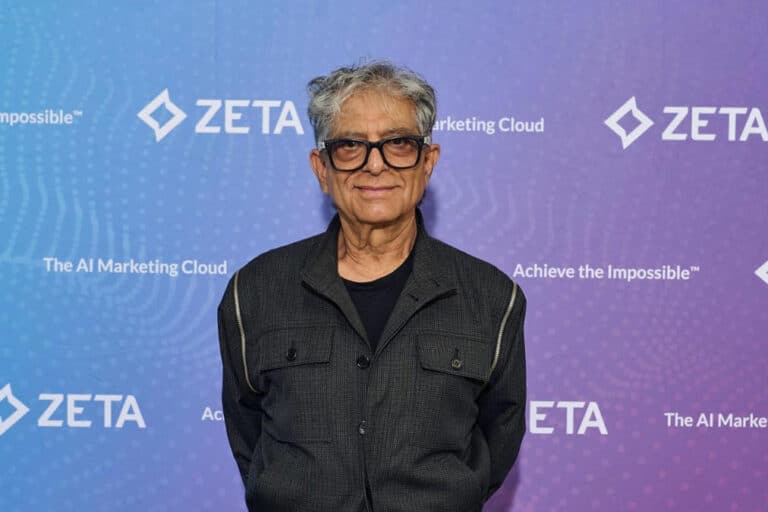

Credit is not only a useful financial tool but also a significant responsibility that shapes your financial future. In this article, Rashid Lakhlu, Director of Credit Risk at AVO Bank, and Mirsardor Usmonov, Head of CRIF KAX, provide practical tips on how to avoid common mistakes, maintain a positive credit history, and make the most of borrowing.

As of December 1, 2024, the total lending portfolio of banks in Uzbekistan reached UZS 525.9 trln, an increase of 13% from the previous year. However, 4.3% of this amount consists of non-performing loans, meaning that a portion of borrowers have failed to repay their debts on time. This could lead to difficulties in securing future loans.

How financial behaviour impacts access to loans

The term «blacklist» is often used to describe situations where individuals with poor credit histories are denied access to financial services. However, according to Mirsardor Usmonov, CEO of CRIF KAX, a leading credit bureau, there is no formal blacklist in practice. Instead, financial institutions rely on detailed credit reports that analyse borrowers’ past financial behaviour.

«These reports assess the creditworthiness of potential borrowers based on their financial track record. Credit bureaus aim to provide an objective, data-driven assessment of credit risks. For example, our bureau works with banks and major instalment-based businesses in Uzbekistan,» Usmonov explained.

A poor credit history often leads to loan rejections, including for mortgages, Usmonov added. The primary cause of a damaged credit history is failing to maintain consistent payment discipline. Missed payments or unresolved debts can tarnish a borrower’s reputation, making it harder to secure new loans in the future.

An expert from AVO Bank emphasised the critical role of credit scoring systems in helping banks assess risks and make informed decisions. These advanced models analyse a range of data, such as payment history, income levels, financial obligations, and other relevant factors, to offer an objective evaluation of a client’s credit reliability.

Such tools not only enhance the transparency and accuracy of lending decisions but also reinforce the importance of financial responsibility. Even small delays in repayments can negatively impact a borrower’s credit history, limiting their access to future financial services. Conversely, consistent and responsible financial habits can improve credit scores, creating more opportunities for borrowers to secure loans on favourable terms.

How AVO Bank Supports Borrowers

Rashid Lakhlu, Director of Credit Risk Management at AVO Bank, outlined the institution’s proactive approach to assisting customers facing challenges in meeting their payment obligations. The bank provides several convenient communication channels to address such issues.

Firstly, clients receive timely push notifications about upcoming payment deadlines and any overdue amounts. Secondly, the AVO Bank app allows users to access accurate, up-to-date information on their outstanding balances and minimum payment requirements, enabling them to stay informed and act promptly.

For customers already experiencing financial difficulties, the bank strongly encourages establishing an open dialogue as soon as possible.

«It is crucial to understand the reasons behind a client’s financial challenges and to offer guidance, whether by explaining loan terms or helping to develop a repayment plan. This approach not only assists clients in managing their debts but also fosters long-term relationships, which benefit both parties,» Lakhlu explained.

To maintain a positive credit history, Rashid Lahlou emphasised the importance of making timely payments to settle outstanding debts. Meeting loan obligations on schedule is a fundamental factor in building and maintaining a strong credit profile.

Additionally, borrowers should keep their credit cards active by making purchases and repaying the balances within the interest-free period. A long and consistent credit history positively impacts credit scores. However, frequent credit applications can harm creditworthiness, so it is advisable to minimise unnecessary credit requests, the AVO Bank representative advised.

Strategies for Timely Debt Repayment and Credit History Recovery

Lakhlu advises borrowers to plan their finances. By assessing income and expenses, individuals can allocate sufficient funds for debt repayment.

One effective method to avoid overdue payments is to set up automatic transfers by linking a salary card to the bank’s app.

«Whenever possible, set reminders on your phone or calendar to keep track of payment deadlines. Avoid exceeding reasonable credit card limits to prevent accumulating significant debt. Most importantly, be aware of your payment due dates and plan your budget accordingly,» he explained.

Resolving Overdue Payments

Maintaining open communication between borrowers and banks is essential. Borrowers should promptly inform their financial institutions about financial difficulties to find a solution together. For instance, AVO Bank recommends making at least the minimum payment to exit the overdue status and protect the credit score.

Customers can also seek advice through the bank’s call centre, where specialists are available to assist and explain convenient repayment options. Additionally, updating contact details in the bank’s app ensures borrowers receive timely notifications about payment deadlines.

«These recommendations help clients manage their finances responsibly. By following these tips, you can strengthen your financial stability and establish a solid foundation for achieving long-term goals. Open communication enables finding compromises and maintaining a sustainable partnership,» concluded Rashid Lakhlu.

Recovering Damaged Credit History

Mirsardor Usmonov emphasised that restoring a damaged credit history requires strict adherence to repayment obligations.

«This involves meeting all current debt repayment conditions. Over time, the credit history improves gradually. However, the process can take several months or even years, depending on the severity of the violations,» the expert stated.