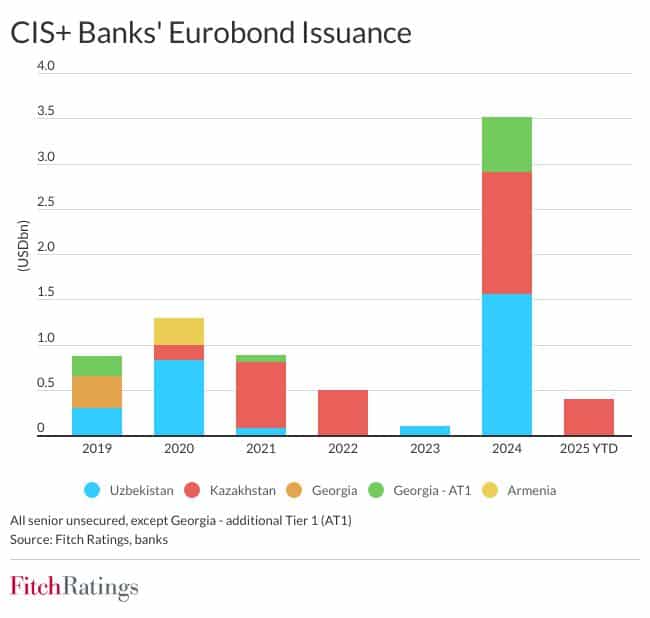

Banks in Uzbekistan and Kazakhstan are likely to lead Eurobond issuance in the CIS+ region in 2025, driven by refinancing needs, strong economic growth, and favourable investor sentiment. Total Eurobond placements in the region could approach the record $3.5 bn issued in 2024, significantly higher than the previous peak of $1.3 bn in 2020. This announcement comes from Fitch Ratings.

Refinancing and market growth drive issuance

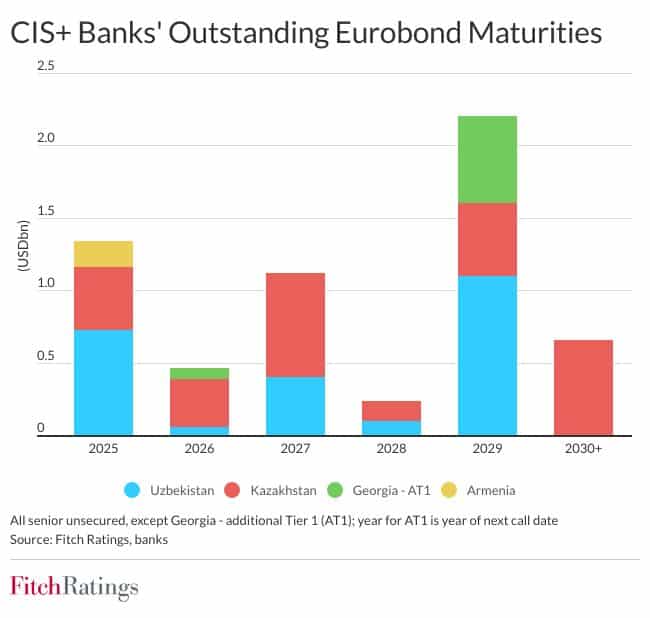

CIS+ banks are expected to issue new Eurobonds primarily to refinance existing debt, with $1.8 bn maturing in 2025–2026. Additionally, strong loan growth and stable economic conditions are likely to support bank performance, further encouraging issuance. Investors continue to show interest in emerging markets, particularly in Uzbekistan and Kazakhstan, while geopolitical risks remain a key factor in the region.

Pent-up demand for debt issuance, following limited activity in previous years, may sustain market momentum. Russian banks, historically the largest issuers in the region, remain excluded from international markets, creating new opportunities for other CIS+ institutions to attract investors.

Uzbekistan’s banks focus on diversifying funding

Uzbek banks are expected to place Eurobonds ahead of their $0.7 bn maturities in 2025, following the country’s sovereign Eurobond issuance in February. External foreign-currency debt plays a key role in Uzbekistan’s banking sector, reflected in a high loans-to-deposits ratio of 173% at the end of 2024. Some Uzbek banks may issue Eurobonds for the first time to support loan growth and diversify funding sources beyond state-backed financing. Additionally, soum-denominated external debt issuance may continue while the exchange rate remains stable.

Kazakhstan’s banks remain active in the market

The Development Bank of Kazakhstan, a key issuer in the region, raised $1.4 bn in Eurobonds in 2024 to refinance most of its 2025–2027 debt maturities. The bank may return to international markets in line with its long-term strategy to increase market-based funding. Other Kazakh banks could also issue Eurobonds due to the rising loans-to-deposits ratio, which reached 83% at the end of 2024, up from 76% in 2022. However, liquidity in Kazakhstan’s banking sector remains strong, reducing the immediate need for foreign debt refinancing.

Limited issuance in other CIS+ countries

Banks in Armenia, Azerbaijan, and Georgia are less likely to issue Eurobonds in 2025. Georgian banks TBC Bank and Bank of Georgia may face weaker investor interest due to political risks, which are reflected in the country’s sovereign rating outlook. In Azerbaijan and Armenia, banks hold strong liquidity positions, reducing the need for external funding. The International Bank of Azerbaijan had a low loans-to-deposits ratio of 62% and a funding cost of 1.9% at mid-2024. Meanwhile, Armenia’s Ardshinbank saw its loans-to-deposits ratio drop significantly due to deposit inflows from Russia in 2022.

Outlook for 2025

Eurobond issuance in the CIS+ region is expected to remain strong, with Uzbekistan and Kazakhstan leading the market. Refinancing needs and economic growth will likely drive activity, while geopolitical factors and investor sentiment will continue to shape market conditions. Other countries in the region may see limited issuance due to strong liquidity positions and lower external funding requirements.