Bitcoin Turns Greener: Will Energy Policies Decide Its Climate Impact

Bitcoin has often been seen as the «bad guy» in global climate debates — an energy-hungry digital asset contributing heavily to carbon emissions. But a new report by the MiCA Crypto Alliance and research firm Nodiens paints a more nuanced picture: Bitcoin is on track to significantly reduce its carbon footprint by 2030 — but the journey will depend on energy policies and, surprisingly, on Bitcoin’s own market price.

From coal to cleaner power

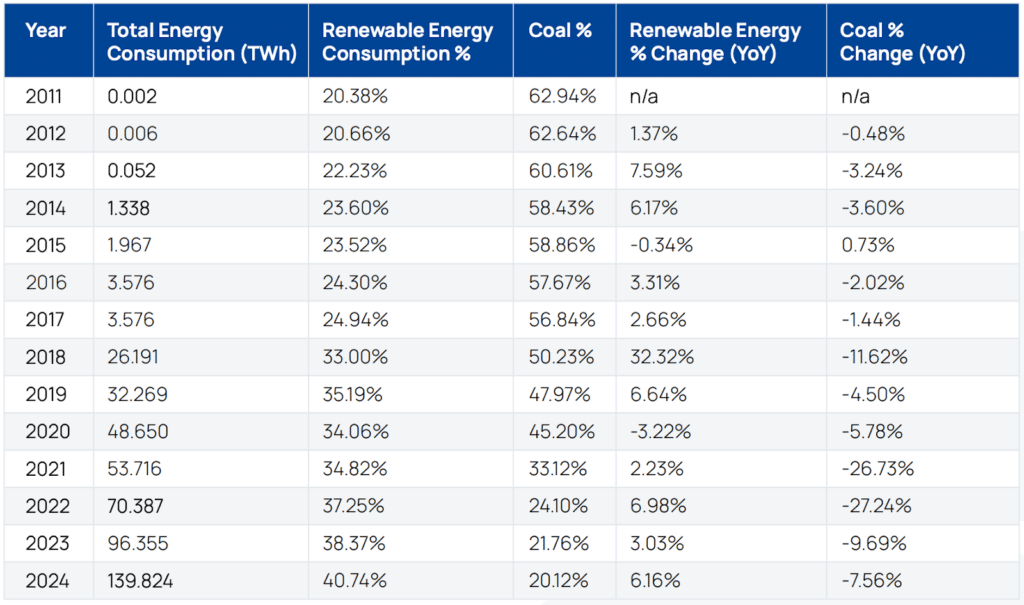

A decade ago, Bitcoin mining — the process of creating new bitcoins — was dominated by coal. In 2011, 63% of Bitcoin’s electricity came from coal, and only 20% came from renewable sources. Fast forward to 2024, and the situation has changed dramatically: the share of coal dropped to 20%, while renewables now account for over 40% of the energy mix.

The key reasons behind this shift?

- The natural search for cheap electricity has led miners towards renewable energy, often cheaper than fossil fuels.

- China’s mining ban in 2021 relocated miners to regions with cleaner energy grids.

- The general decarbonisation of global electricity production.

Bitcoin is even tapping into carbon-negative energy by utilizing flared and vented methane — a gas typically wasted in oil production — which now covers about 2.4% of its energy needs.

The catch: It’s about the price

The report underlines that Bitcoin’s energy consumption doesn’t only depend on how green the electricity is, but also on the price of Bitcoin itself. The higher the price, the more miners enter the market, consuming more power overall.

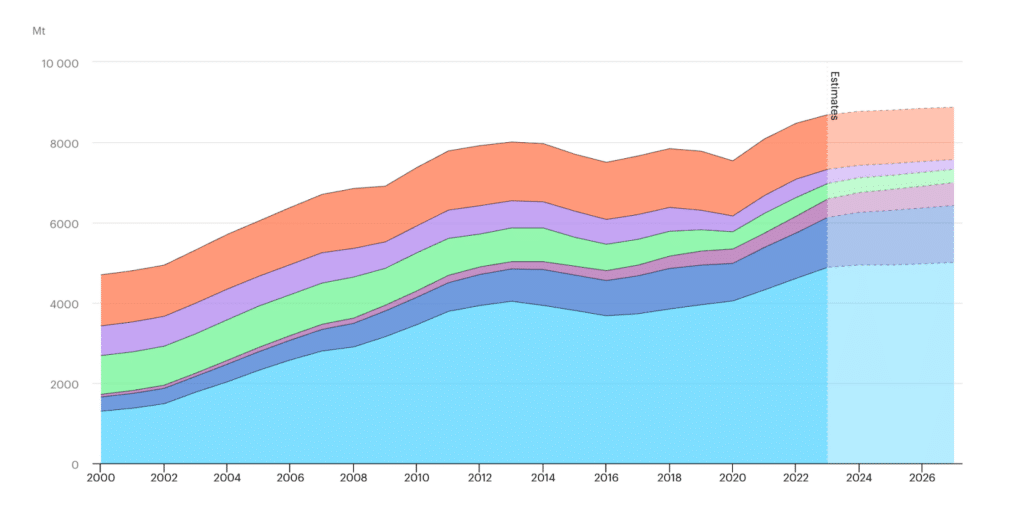

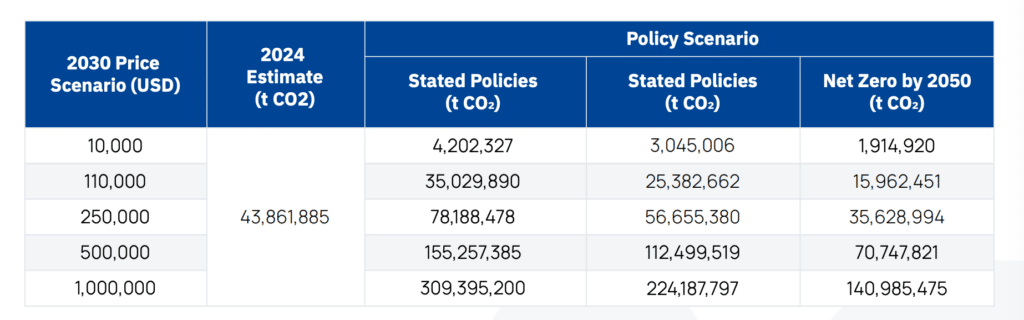

If Bitcoin reaches $250,000 by 2030 (a popular projection among enthusiasts), mining could consume around 482 terawatt-hours (TWh) annually — comparable to the current electricity consumption of countries like France or Brazil. Under even more bullish scenarios, where Bitcoin hits $500,000 or $1 mln, energy demand could nearly double.

Can renewables keep up?

Even in these high-demand scenarios, the situation might not be as grim as it seems. The report shows that if global energy grids continue their shift towards renewables — driven by policies like the UN’s Sustainable Development Goals or the Net Zero by 2050 initiative — Bitcoin’s carbon footprint could remain manageable.

Under the Net Zero scenario, even at a Bitcoin price of $500,000, emissions would be around 70 mln tonnes of CO₂ — lower than today’s Bitcoin emissions, thanks to a cleaner electricity grid.

Why it matters

For Uzbekistan and other developing countries where interest in crypto mining is growing, this report serves as a double-edged sword. On the one hand, Bitcoin can become significantly greener if paired with renewable energy. On the other hand, if fossil fuels remain cheap and policies weak, Bitcoin’s growing energy appetite could still pose a climate challenge.

The report concludes optimistically, stating that Bitcoin is on a low-carbon pathway, especially if renewable adoption and mining innovation continue. However, it also warns that the next five years are crucial.

«Even under high-price scenarios, Bitcoin is unlikely to exceed 1% of global carbon emissions,» the authors note.

What’s next

The debate on Bitcoin’s environmental impact is far from over. But the latest data suggests that Bitcoin is not locked into a dirty future — its environmental footprint is still largely in human hands, shaped by energy policies, market dynamics and technological choices.