In recent years, Uzbekistan has made significant progress in creating an attractive investment climate. Thanks to tax reform, digitalisation and strong support for the private sector, the country has sparked growing interest among international investors, both institutional and individual. However, attracting capital alone is not enough to ensure sustainable economic growth. Now, Uzbek businesses must take the next step—expanding into foreign markets. This was the message shared by Anvar Rasulev, founder of the investment company Ansher Capital, in an interview with Kursiv Uzbekistan.

Attracting investors: important, but not enough

According to Rasulev, foreign investor interest in Uzbekistan has matured. Previously, international funds would buy shares merely to «test the waters,» but now they come with more strategic, long-term approaches.

«I especially want to highlight our tax policy. We have low rates: for example, personal income tax is 12%, unlike 40% or more in Europe. The same goes for dividend tax—this is a strong incentive for investors. Plus, digitalization is advancing rapidly in the country, with marketplaces and ecosystems emerging,» Rasulev noted.

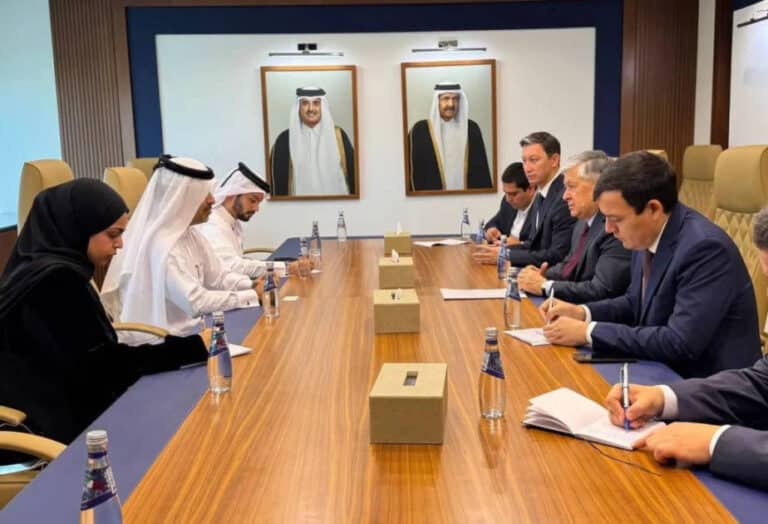

Ansher Capital is seeing strong interest from the Middle East, particularly Saudi Arabia and the UAE. The company currently manages numerous buy-side and sell-side mandates involving Gulf-based firms. And it’s not just about resource assets, there is rising demand for IT firms, e-commerce players, and payment solution providers.

Investors are aiming to build complete ecosystems, such as combining a marketplace with a bank and a microfinance institution. This underscores the long-term nature of their interest.

Logistics is also drawing attention, particularly warehouses and distribution centers, given the growth in trade with China and the rise of e-commerce.

Traditional interest remains in gold mining assets, while cement-related assets are also in demand, especially from Chinese and Middle Eastern companies.

Uzbekistan must look beyond its borders

Rasulev firmly believes that for sustainable development, Uzbekistan must not only accept investment but also expand into international markets itself. Without external expansion, sustainable economic growth is not possible, he argues.

«We’re doing everything to showcase our strengths to investors. But international experience shows that this is not enough. For real development, the country must go out into the world and acquire foreign assets,» he said.

He offered the textile industry as an example: to fully export products, you need ports, logistics hubs and distribution warehouses abroad.

China’s example: how state-backed expansion works

Rasulev pointed to China as a model, where foreign expansion has long been a part of national strategy. He noted that China has systematically built a global presence, not only through goods exports but also by acquiring key infrastructure and resource assets.

«China has implemented state programs for years aimed at external expansion. Banks offer favorable financing terms to support foreign asset acquisitions—whether it’s mineral resources, logistics hubs, or tech companies,» Rasulov explained.

In his view, Uzbekistan cannot match this scale, but it should adopt the same direction.

«We too must move in that direction and actively pursue external expansion. The key is to support people and companies who aim to operate abroad and acquire assets. Over time, this will have a significant positive impact on our economy,» Rasulev emphasised.

Foreign assets serve national interests

According to Rasulev, expansion is not an abstract goal but a tangible tool for industrial development. He cited the example of Uzbekistan’s steel industry. The country lacks its own iron ore and must import it from Russia, Kazakhstan, and China.

«If we could acquire such deposits in neighbouring Kazakhstan, we’d not only develop a company there, but also secure stable, cost-effective, and timely raw material supplies for Uzbekistan,» he said.

He is convinced that even without domestic deposits or infrastructure, the country can own foreign assets that benefit its economy.

Kursiv Uzbekistan also reports that during the Capital Market: New Investment Opportunities conference, experts discussed the advantages companies can gain from issuing bonds.