Uzbekistan’s banking sector ended the first half of 2025 on the rise. Assets and deposits grew at double-digit rates, and the loan portfolio — by almost 8%. However, individual banks’ results varied widely: some strengthened their leadership, while others ended up in the red. Kursiv Uzbekistan reviews what results market players showed in the first half of the year.

From this article you will learn:

- Agrobank surged ahead in its loan portfolio, but was left without big profits

- Problem loans: share declining

- Deposits: growth for some and decline for others

- Profit: dynamics of leaders and those catching up

Credit Boom: Agrobank Surged Ahead but Was Left Without Big Profits

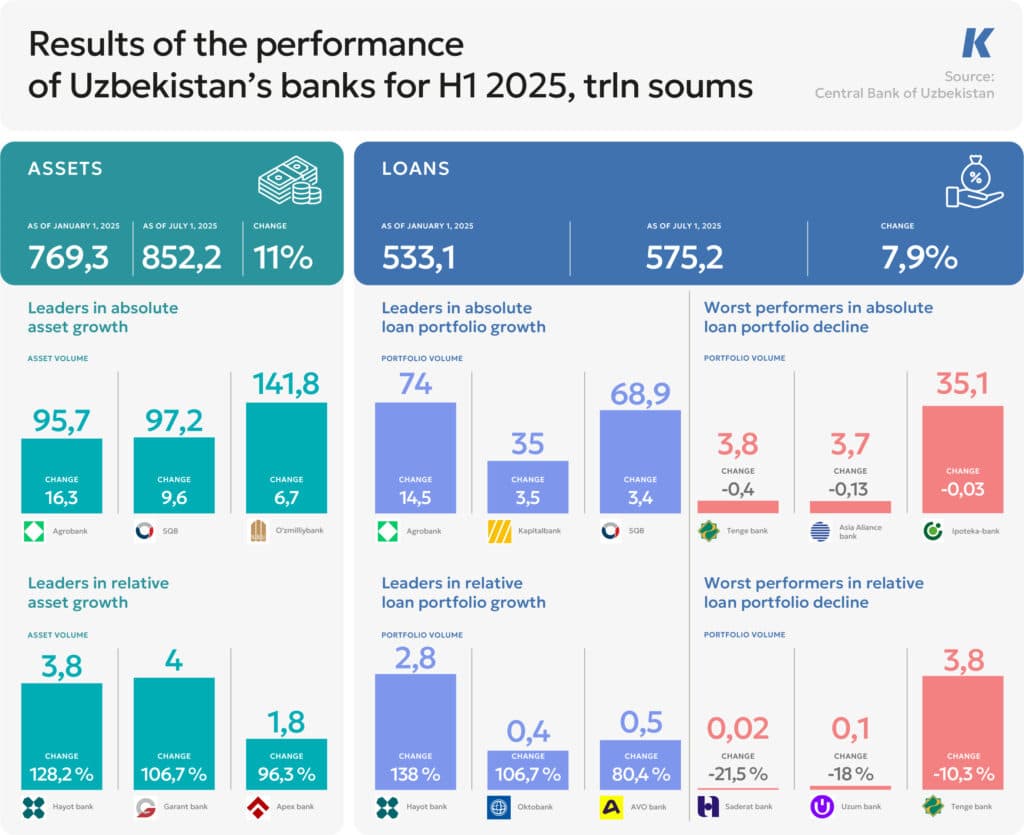

The leading financial institution in loan portfolio growth in the first half of the year was Agrobank. In absolute terms, its portfolio increased by 14.5 trln soums, accounting for a third of the sector’s total growth (+42.1 trln). The bank significantly outpaced its nearest competitors: second place went to Kapitalbank with growth of 3.5 trln soums, and third to SQB with +3.4 trln soums.

This noticeable increase allowed Agrobank to rise to second place in Uzbekistan by loan portfolio size, behind only NBU. At the start of the year, this position was held by SQB. The main driver of growth was corporate clients: the corporate loan portfolio grew from 50.2 trln to 62.3 trln soums.

However, the impressive loan volume did not bring Agrobank comparable income. By net profit it did not even enter the top 20, earning only 35.3 bn soums. For comparison, the top three are: NBU — 1 trln, SQB — 808.6 bn, Hamkorbank — 806.8 bn soums.

With such a result, the bank did not fulfil its own 2025 business plan: for the first half of the year it had planned 229 bn soums in profit, but actually received 6.5 times less. One key reason was lower-than-planned interest income: instead of the planned 8.3 trln soums, the bank earned 7.7 trln.

The financial institution specialises in lending to the agricultural sector, where rates are traditionally lower and margins smaller. Agrobank participates in preferential state programmes, which do not generate income comparable to private banks focused on the commercial segment.

For comparison: some players with smaller assets managed to outperform Agrobank in earnings. For example, TBC Bank increased its loan portfolio by 3 trln soums (+40.2%) and showed net profit under NSBU of 101 bn soums, ranking only 15th by loan volume.

These figures show that private banks in Uzbekistan are gradually strengthening their positions. Some players still have modest loan portfolios, but in relative terms their growth is impressive. This is largely explained by the low base effect, but the trend indicates increased activity in lending. Leaders in growth rates are Hayot Bank (+138%), Octobank (+106.7%) and AVO Bank (+80.4%). Hayot Bank brought its portfolio to 2.8 trln soums, with growth mainly from loans to individuals (an 18-fold increase). AVO Bank also focused on the retail segment, while Oktobank bet on corporate clients.

Some players had negative dynamics. Tenge Bank reduced its portfolio by 0.4 trln soums (–10% in relative terms), Asia Alliance Bank, by 133 bn (–3.5%), and Ipoteka Bank by 28 bn soums, which is just –0.1%.

Problem Loans: Share Declining

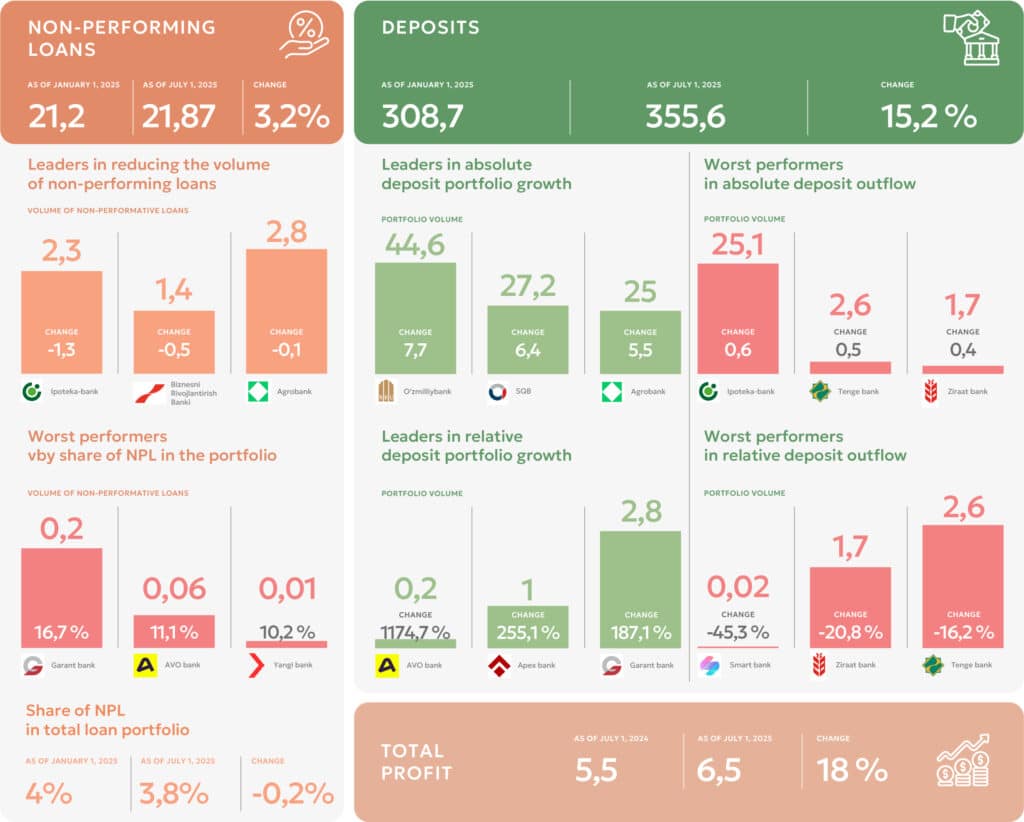

The volume of problem loans in the banking system grew by 3.2% over six months. However, the overall loan portfolio increased by almost 8%, allowing the NPL share to fall from 4% to 3.8% — the portfolio grew faster than the volume of problem assets.

At the same time, for individual players the indicator is noticeably above the market average. Leading the list is Garant Bank with 16.7% NPL, second is AVO Bank (11.1%), and third is Yangi Bank (8.3%).

Meanwhile, some banks significantly reduced the volume of non-performing loans. The largest decrease was shown by Ipoteka Bank (–1.3 trln soums), followed by the Business Development Bank (–0.5 trln) and Agrobank (–0.1 trln).

Deposits: Growth for Some and Decline for Others

By volume of attracted deposits in absolute terms, the leaders are NBU (+7.7 trln soums), SQB (+6.4 trln) and Agrobank (+5.5 trln).

In relative terms, as in the loan segment, the leaders were small banks actively expanding their client base. The leader was AVO Bank: deposits from individuals grew from 3 bn to 142 bn soums, and from legal entities — from 14 bn to 74 bn. Next are Apex Bank (+255.1%) and Garant Bank (+187.1%).

Some players saw an outflow of funds. At Ipoteka Bank it amounted to 0.6 trln soums (–2.3%), at Tenge Bank, 0.5 trln (–16.2%), and at Turkey’s Ziraat Bank, 0.4 trln (–20.8%). The last two also entered the top three banks with the largest relative drop in deposits, but the list is topped by Smartbank — a fall of 45.3%. According to the bank’s website, it offers only a savings account without interest. Therefore, client funds are modest — only 23 bn compared to 42 bn at the start of the year.

Average rates on fixed-term deposits in national currency for individuals fell over six months from 22.1% to 21.4%, for legal entities they rose from 16.8% to 17.9%.

Deposit dollarisation as of July 1 stood at 24% versus 25% at the start of the year. Over six months, the soum strengthened against the US dollar by about 1.6%, so foreign-currency deposits did not significantly affect the overall dynamics of the deposit market. The same conclusion applies to loans. The share of foreign-currency loans fell slightly — from 43% to 42%.

Profit: Dynamics of Leaders and Followers

In the first half of 2025, the leader in net profit was NBU — 1 trln soums. This is 60.3 bn more than a year earlier, allowing the bank to strengthen its leadership in the sector. Second place went to SQB with 808.6 bn soums (+40.2 bn). Third was Hamkorbank, earning 806.8 bn soums (+138.7 bn).

The top ten most profitable also included Kapitalbank (602.4 bn), OFB (523.5 bn), Ipak Yuli Bank (485.1 bn), Business Development Bank (319.7 bn), KDB Bank (311 bn), Davr Bank (298 bn) and Asia Alliance Bank (236.9 bn).

At the other end of the ranking were the banks with the largest losses. The absolute anti-leader is Ipoteka Bank, ending the half-year with –392.5 bn soums versus profit a year earlier. Second by loss is Apex Bank (–62.4 bn), third is Yangi Bank (–55.6 bn). Significant negative results were also shown by Eurasian Bank (–51.6 bn) and Garant Bank (–9.7 bn).

Overall, the system’s total profit for the half-year amounted to 6.51 trln soums, which is 991 bn more than a year earlier (+18%).

Earlier, Kursiv Uzbekistan reported on the results of Uzbekistan’s banks in 2024. Loan portfolio growth slowed compared to the previous year from 21% to 13% amid tighter lending requirements. Deposits, on the contrary, accelerated from 11.5% to 27.7%, explained by high real interest rates. Despite the generally positive trend, total banking profits after two years of rapid growth almost halved, to 7 trln.