Oracle’s shares rocketed by over 40% to a record high on September 10, fuelled by news of landmark AI-related contracts that put the tech giant within striking distance of the $1 trln valuation mark. The surge also sent co-founder Larry Ellison’s wealth soaring, narrowing the gap with Tesla’s Elon Musk in the contest for the world’s richest individual.

The company announced four multi-billion-dollar cloud agreements, with the largest reported to be a $300bn deal to provide computing power to OpenAI over the next five years. Wall Street Journal described it as one of the biggest cloud contracts in history. Oracle declined to comment, while OpenAI offered no immediate response.

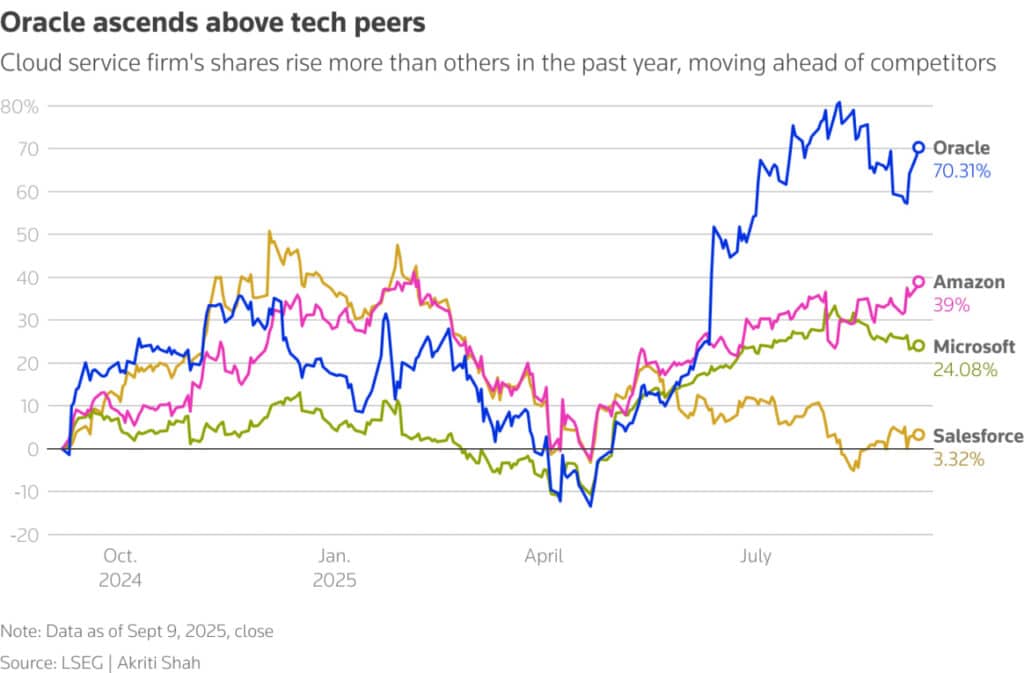

At its peak, Oracle’s stock rose to $345.69, marking its biggest one-day gain since 1992. The rally is expected to add around $234bn to the company’s market capitalisation, bringing it to roughly $913bn. Shares are now up 45% for the year, outperforming both the broader S&P 500 index and even the so-called Magnificent Seven tech stocks, as investors flock to AI-driven cloud firms.

Ellison’s Fortune Climbs by $100bn

Ellison, 81, holds a 41% stake in Oracle, and the latest stock surge has lifted his fortune by about $100bn to $392.6bn, according to Forbes. He is edging closer to Elon Musk, whose net worth is currently estimated at $439.9bn.

Chief executive Safra Catz said during a post-earnings call that the company expects to secure more multi-billion-dollar customers in coming months and forecast its remaining performance obligations could surpass $500bn.

Oracle Gains Momentum in Cloud Race

Oracle remains smaller than industry leaders Microsoft, Amazon Web Services and Google Cloud, which together control around two-thirds of the market, but the OpenAI contract signals growing momentum. The firm has also been tied to SoftBank and OpenAI’s Stargate project, which is expected to involve about $500bn of investment in large-scale AI infrastructure.

The company’s cloud services are already being used by xAI, Elon Musk’s artificial intelligence start-up. Partnerships with Amazon, Alphabet and Microsoft allow cloud clients to use Oracle Cloud Infrastructure alongside their providers’ native services, with revenue from these collaborations rising more than sixteen-fold in the first quarter.

The share surge also boosted other technology players, with Nvidia, AMD and Broadcom climbing between 2% and 8%, and competitor CoreWeave jumping 15%. Analysts noted that Oracle’s position in Stargate and its expanding AI contracts provide strong tailwinds for growth well beyond 2026.

Global Ripple Effect

The rally set off a wave of AI enthusiasm across Asia, with stock markets in Japan, Taiwan and South Korea hitting record highs. In Tokyo, SoftBank, a partner in the Stargate project, surged 9%. European stocks, however, remained subdued as investors awaited an interest rate decision from the European Central Bank.

Kursiv also reports that the combined fortune of the 400 richest Americans has reached an unprecedented $6.6 trln.