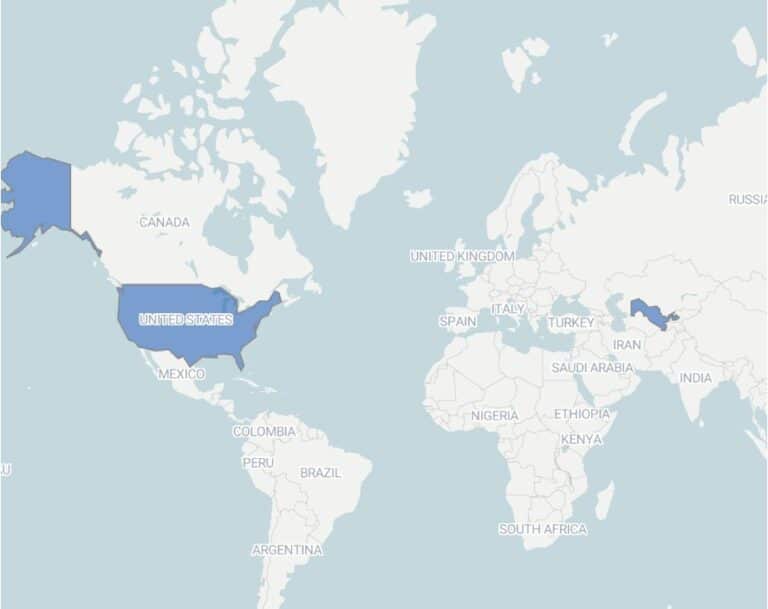

The European Bank for Reconstruction and Development (EBRD) has forecast average economic growth of 6.1% across Central Asia in 2025, according to its latest Regional Economic Prospects report. Bank’s projection covers Kazakhstan, the Kyrgyz Republic, Mongolia, Tajikistan, Turkmenistan and Uzbekistan.

The Bank attributes this performance to strong industrial output, resilient domestic demand, rising real wages, investment flows and continued remittance growth. For 2026, the outlook remains positive though growth is expected to ease to 5.2%. Main risks include volatility in commodity markets, dependence on remittances and heavy reliance on Russian and Chinese demand.

Uzbekistan: services and manufacturing drive growth

Uzbekistan’s GDP grew by 7.2% in the first half of 2025, supported by strong services, higher wages and nearly 29% growth in remittances. Industry benefited from food and metallurgical output and mining gained from global gold prices, offsetting weaker gas extraction. The EBRD expects growth of 6.7% in 2025 and 6.0% in 2026, driven by domestic demand, foreign investment and diversified manufacturing.

Kazakhstan: energy-led growth

Central Asia’s largest economy has seen a strong 2025, driven by rising oil production at the Tengiz field, which lifted industrial growth and supported wholesale trade and transport. Construction also surged by 18.4% in the first half of the year due to infrastructure projects and housing development. The EBRD forecasts GDP growth of 5.7% in 2025, easing to 4.5% in 2026, with risks tied to commodity prices and reliance on Russian oil transit routes.

Kyrgyz Republic: regional frontrunner

The Kyrgyz economy expanded by 11.4% in the first half of 2025, led by construction, trade and manufacturing. Public investment, rising wages and robust remittances have driven growth, alongside a buoyant tourism sector. The EBRD projects GDP growth of 9.0% in 2025, slowing to 6.0% in 2026, though a decline in remittance inflows remains a risk.

Tajikistan: strong momentum

GDP in Tajikistan rose by 8.1% in the first half of 2025, supported by trade, agriculture, transport and a near doubling of mining activity. Real wages climbed by 17.2% and remittances surged by 64%. The EBRD projects growth of 7.5% in 2025 and 5.7% in 2026, underpinned by gold prices, infrastructure and remittances.

Turkmenistan: broad-based expansion

Turkmenistan’s economy expanded by 6.3% in early 2025, led by construction, services and trade. Investment rose by 15.6% year on year. Growth is expected to remain steady at 6.3% in both 2025 and 2026, driven by energy, agriculture and infrastructure.

Mongolia: consumption supports growth

Despite weaker mining activity, Mongolia’s GDP grew by 5.6% in early 2025 thanks to a rebound in agriculture and strength in services. Consumer spending, private investment and rising wages have underpinned demand. Growth is forecast at 5.8% in 2025 and 5.5 % in 2026, though weaker Chinese demand may weigh on performance.

Kursiv also reports that the EBRD will provide $250 mln to upgrade 110 irrigation pumping stations across Uzbekistan