Japan’s seven largest automakers saw US tariffs reduce their combined earnings by 1.5 trln yen ($9.74 bn) for the period from April to September 2025, according to half-year results released on Monday. This marked the first decline across the board since the COVID-19 pandemic.

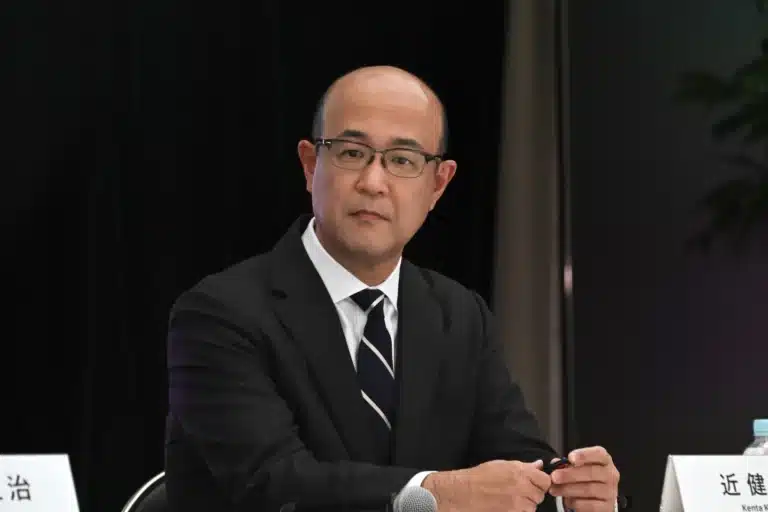

Honda executive vice president Noriya Kaihara described the situation as «the new normal» expected to continue. Tariffs of 27.5% were in place for most of the period before being lowered to 15% on September 16. A stronger yen also reduced the group’s operating profit by 700 bn yen ($4.5 bn). Nissan, Mazda and Mitsubishi reported net losses. The total net profit for the seven companies was just under 2.1 trln yen ($13.6 bn), down 30% year-on-year. Without the tariff and exchange rate effects, profits would have risen.

Mazda and Subaru Most Exposed

Subaru and Mazda, heavily dependent on the US market, were among the hardest hit. Mazda posted a net loss for the first time in five years as tariffs cut profits by 97.1 bn yen ($629.7 mln). Subaru’s profits were erased by tariffs on vehicles making up 80% of its US sales, prompting a cost-cutting plan targeting 200 bn yen ($1.3 bn) by 2030.

Toyota was the best performer, with strong hybrid sales cushioning the impact of 900 bn yen ($5.8 bn) in tariffs. Global sales grew by 5%, while net profit fell by 7%. Sales rose 6% in China, highlighting Toyota’s strength abroad.

Automakers now face supply risks after Chinese-owned chipmaker Nexperia suspended shipments. Honda reduced production in Mexico and the US, cutting forecasts by 150 bn yen ($972.8 mln), while Suzuki is monitoring chip supply but remains largely unaffected by tariffs.

All seven companies based forecasts on an exchange rate of 140-147 yen per dollar, while the current 154 yen rate has been beneficial. Analysts caution the full effects of tariffs are still unfolding.